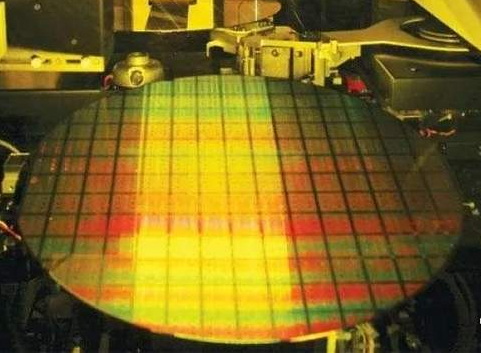

In order to maintain the capacity utilization rate, some wafer foundries have reduced prices

Time:2022-09-01

Views:1783

According to Taiwanese media reports, Chinese Mainland‘s wafer foundry manufacturers have started to cut prices by 10%, which also affects the "preferential prices" of some Taiwanese wafer foundry for specific processes to prevent order loss, which is equivalent to a disguised price reduction. In this regard, market sources pointed out that at present, the wafer foundry in Chinese Mainland has indeed reduced the price, in order to prevent the capacity utilization rate from falling too much.

According to the report, an unnamed IC designer pointed out that the price of chips produced in the mainland wafer foundry has been reduced by more than 10%. It is expected that the cost of related chips will be reduced from the fourth quarter. The report also quoted another IC designer as saying that after the price reduction was announced by the mainland wafer foundry, some Taiwan wafer foundry also began to take countermeasures, such as giving a single digit percentage discount for some manufacturing processes, so as to reduce the risk of orders flowing to the mainland wafer foundry. This is tantamount to "price reduction in disguise".

In addition, the report also said that there was news about the supply chain. Under the impact of weak client demand, the wafer production capacity has indeed been loosened. In order to maintain production capacity, some companies even put forward the practice of placing an order for three final designs and sending one final design. That is, the practice of buying three for one is a disguised price reduction. The purpose is to maintain production capacity utilization.

In this regard, analysts from Jibang, a market research and research institution, pointed out that there are indeed reports of price reductions in the mainland wafer foundry. However, as long as the price reduction targets are mainly 8-inch wafers, and the price reduction range is around 10%, the reason for the price reduction is to avoid a sharp decline in the utilization rate of production capacity.

However, the report did not disclose which mainland wafer foundry lowered the price and which Taiwan wafer foundry "lowered the price in disguise". Xinzhixun sought confirmation from relevant personnel of some domestic wafer factories and also found out which wafer foundry announced price reduction. In addition, it has been reported that many touch chip manufacturers and consumer chips have said that they have not heard of any disguised price reduction in Taiwan based fabs. Although the utilization rate of wafer foundry capacity has declined, the foundry is mainly coping with the problem through product line adjustment and has not started to reduce the price.

It is worth noting that the leading manufacturers in the wafer OEM market are still raising their prices. In May this year, TSMC informed customers that it would increase the wafer OEM price by 5% - 10% from January 2023. Some TSMC customers have confirmed that they have received the notice of price increase, and the advanced manufacturing process has increased by 7% - 9%. In addition, according to the report of Bloomberg, Samsung will also start to raise the price of wafer OEM in the second half of the year, and the price of some manufacturing processes will rise by as much as 20%.

With the weakening of the demand of the terminal market, the wafer OEM market has indeed begun to cool down, and the mature process is the most significant. For example, Li Jidian, which specializes in wafer OEM of mature processes, disclosed a few days ago that panel drive IC, image sensor and niche memory products are likely to face major revisions. Customers of existing panel drive IC manufacturers would rather pay liquidated damages to ease the pressure on inventory. Due to the impact of product line conversion, the capacity utilization rate may decline by 5% to 10% in the third quarter. According to the data, the proportion of long-term contracts signed with semiconductor silicon wafer suppliers by Li Jidian was as high as 70%, and the remaining 30% did not sign long-term contracts.

Another world advanced company, which is mainly engaged in wafer OEM of mature processes, has recently encountered the problem of reducing the number of customers‘ chips. World advanced frankly said that it has been affected by the inventory adjustment of some products in the supply chain, which will affect the capacity utilization rate in the second half of the year. In other words, the subsequent demand of world advanced for semiconductor silicon chips will also be reduced due to the decline in capacity utilization rate.

However, up to now, it seems that the world‘s advanced wafer foundry enterprises, such as Li Jidian, have not started to reduce their prices.

Even though some wafer OEM manufacturers are willing to reduce the price, the wafer OEM price has increased a lot during the chip shortage period in the past two years. Therefore, after the current price reduction, the price is still much higher than the price before the price increase.

|

Disclaimer: This article is transferred from other platforms and does not represent the views and positions of this site. If there is infringement or objection, please contact us to del |