Early warning of new low chip output! The latest progress and trend of China‘s semiconductor industry

Time:2022-09-03

Views:1788

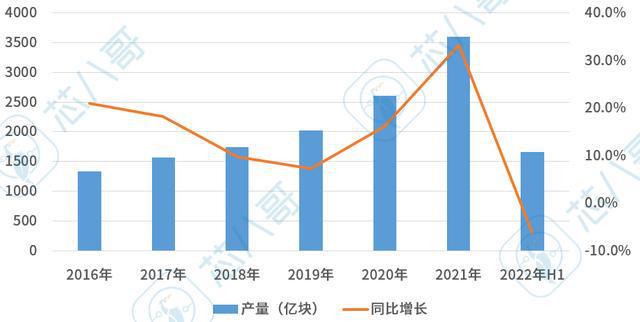

Ice and fire: output declines, import and export soar

In recent years, the output of the domestic integrated circuit industry has maintained a high-speed growth, especially in 2021, China‘s integrated circuit output was 359.4 billion, a year-on-year increase of 33.3%, the highest year-on-year increase in the last 10 years. However, what is unexpected is that in the first half of 2022, the domestic integrated circuit output was only 166.1 billion, a year-on-year decrease of 6.3%, which also recorded the first negative growth since 2009.

2016-2022h1 China‘s integrated circuit output and growth

Source: compiled by the National Bureau of statistics and smiley

In terms of specific months, as shown in the figure below, since 1997, the domestic integrated circuit output has maintained a high-speed growth trend, and even the epidemic at the beginning of 2020 has not affected its rapid growth. However, since the beginning of this year, the monthly growth rate of China‘s integrated circuit output has shown a downward trend throughout the first half of this year, with an average decline of more than 10%.

Monthly growth of China‘s integrated circuit output since 2019

Source: compiled by the National Bureau of statistics and smiley

On the contrary, the import and export market of domestic integrated circuits showed a "thriving" trend, with the growth rate of import and export volume in the first half of the year being 5.5% and 16.4% respectively. Among them, the high growth in the export volume of the integrated circuit market is particularly noticeable under the current decline in output.

Growth of import and export of this integrated circuit since 2017

Data source: General Administration of customs, Singapore

Recently, the shortage of cores caused by trade disputes, imbalance between supply and demand, the epidemic and many other factors is gradually returning to rationality. Is it related to the current decline in domestic integrated circuit production and the soaring export volume?

Core reason: demand is the key

To analyze the root cause of this problem, we need to analyze the output and export of integrated circuits separately. In terms of the reduction of domestic integrated circuit production, the following two reasons can not be ignored:

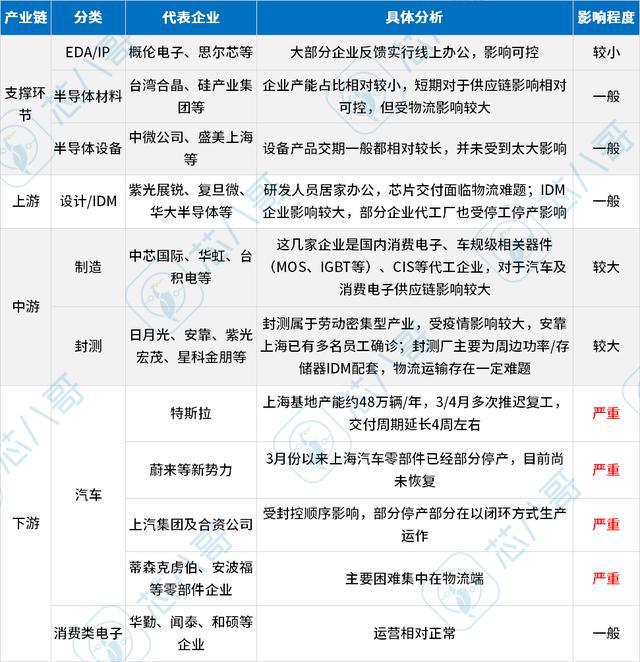

In the short term, the epidemic in Shanghai at the beginning of the year affected the operation of the supply chain to a certain extent.

As we all know, Shanghai, as the core production base of the domestic integrated circuit industry, has a number of wafer foundries such as SMIC, TSMC and Huahong. Since the expansion of the epidemic in Shanghai in April, it has had a great impact on the production and operation of integrated circuit manufacturing, package testing and downstream automobile supply chain.

Evaluation of the impact of Shanghai epidemic on Supply Chain

Source: collated by Starling

In the long run, the impact of the sluggish end demand for downstream household appliances and consumer products is the root cause of the reduction in production. Domestic wafer foundry is mainly concentrated in this field, which has a relatively large impact.

In the long run, the impact of the sluggish end demand for downstream household appliances and consumer products is the root cause of the reduction in production. Domestic wafer foundry is mainly concentrated in this field, which has a relatively large impact.

Since the beginning of 2021, the growth rate of the smartphone and home appliance industry has continued to decline

Data source: wind, core Starling

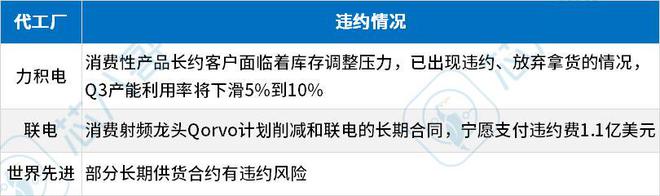

It is reported that the current trend of cutting orders for consumer products has further spread to the OEM end. In the first half of the year, information of order default was "exposed" in liandian, lismc and world advanced. In general, domestic subsidiaries including UMC and TSMC, as well as SMIC and Huahong, account for a relatively large proportion of consumer products and are subject to great fluctuations.

Default of customers of major wafer foundries in the first half of 2022

Source: collated by Starling

In terms of the increase in imports and exports, there are also the following two reasons:

First, from the overall background of the semiconductor industry, the chip market has remained positive in the past two years.

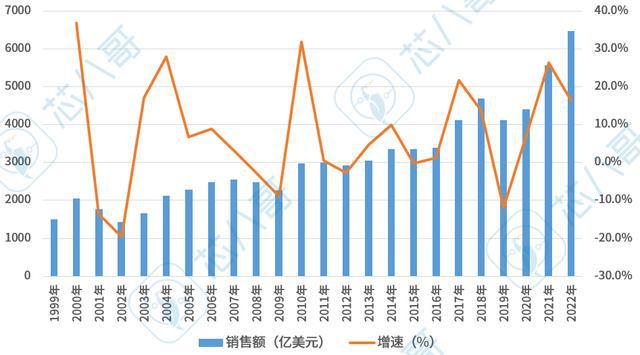

Unlike the sluggish demand for household appliances and consumer goods, the incremental demand for automobiles, industrial control and new energy (energy storage, photovoltaic, etc.) still maintains a high momentum. According to WSTS forecast, the global semiconductor market size will reach 646 billion US dollars in 2022, an increase of 16.3%.

Global semiconductor sales and growth from 1999 to 2022

Source: compiled by WSTS and Starling

Second, the resumption of work and production in China is relatively good, and the competitiveness of integrated circuits is constantly strengthened.

Taking Shanghai as an example, it took less than a month from the expansion of the epidemic to the resumption of production, which is relatively beneficial to restoring confidence in the industry. In addition, with the continuous strengthening of the competitiveness of a number of manufacturing and sealing and testing enterprises represented by SMIC, Huahong and Changdian technology, their competitiveness in the export market has been continuously strengthened relying on a stable supply chain.

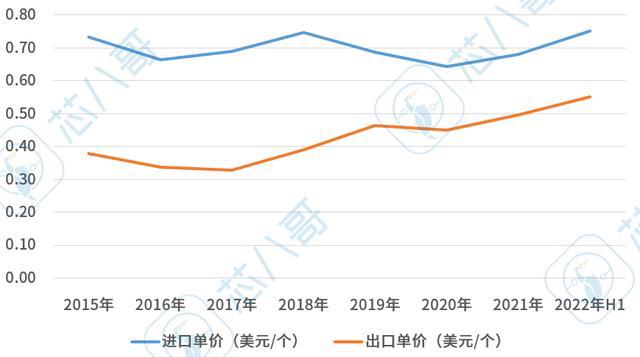

From the data, since 2015, the average unit price of China‘s integrated circuit exports has shown a steady upward trend, with an average price of about US $0.55/piece in 2022h1, an increase of 46% over 2015; From the perspective of the import market, the average unit price of China‘s integrated circuit imports has fluctuated since 2015, and the price has a certain downward trend before the epidemic. In contrast, the competitiveness of the domestic integrated circuit industry has been making progress.

Comparison of import and export unit prices of Chinese integrated circuits in 2015-2022h1

Source: compiled by the National Bureau of statistics, the General Administration of customs and smiley

To sum up, the domestic integrated circuit industry is mainly concentrated in the middle and low-end fields such as household appliances and consumer goods. Due to the sluggish demand and repeated impact of the epidemic, it is inevitable that the short-term output will decline. In the long run, driven by the new incremental demand for automobiles, industrial control and new energy, the semiconductor market at home and abroad still maintains high development expectations, but the turbulence brought by the downturn of the traditional market cannot be ignored.

Some views on the future development of semiconductor industry: increment is the core

In general, with the opening of new production capacity of chip manufacturers, the surplus production capacity of consumer / household appliances is transferred to the shortage areas such as automobiles and industrial control. The shortage boom caused by supply and demand imbalance, trade disputes and repeated epidemics is returning to rationality, and the problem of core shortage is gradually alleviated.

Since the beginning of the year, the delivery date and growth rate of global chips have slowed down significantly

Data source: SFG, core Starling

In the short term, from the perspective of each segment of semiconductor, the trend of chip supply and demand differentiation is obvious. Specifically, "auto / industrial control / new energy (expansion) and consumer electronics (mobile phones, PCs, tablets, etc.) / home appliances (reduction) demand differentiation - slow distribution growth / structural shortage of the original factory - ease / decline of OEM capacity - decline in package testing", the change in terminal demand is gradually transmitted to the upstream chip original factory / distribution and manufacturing links (OEM / package testing). The second half of the year will be the turning point of this round of chip market from prosperity to stability.

Current chip supply chain inventory and price trend

Source: collated by Starling

In the long run, with the rapid development of intelligent vehicles, cloud computing and new energy, the potential incremental demand will be the key to support the high-profile development of chips in the next few years. At the same time, due to geopolitical disputes and repeated epidemics, the trend and impact of the semiconductor industry in the future are still unknown. Superimposing the support policies of various countries for the local chip industry will also be an uncertain factor affecting the global semiconductor industry in the next few years, and cooperation and game will become the "main theme" of the global semiconductor industry.

|

Disclaimer: This article is transferred from other platforms and does not represent the views and positions of this site. If there is infringement or objection, please contact us to del |