Latest prediction! Analysis on demand and market share trend of major downstream terminals of semiconductors

Time:2022-10-01

Views:1704

Source: Huaqiang Microelectronics Author: June

Introduction: The latest news shows that the market share of automotive IC is expected to rise to 10% by 2026. During this period, the sales volume of automotive IC is expected to increase by 13.4% annually, but the communication and computer fields are still the largest applications. It seems that we can also get some inspiration by combining the supply and demand of upstream and downstream terminal applications since this year.

On September 29, IC Insights recently released the third quarter update of the 2022 McLean Report. This update includes a 2020-2026 IC database, which subdivides the IC market by major product types, including consumers in the Americas, Europe, Japan, China and the Asia Pacific region, as well as automotive, computer, industrial, communications and government/military end use applications.

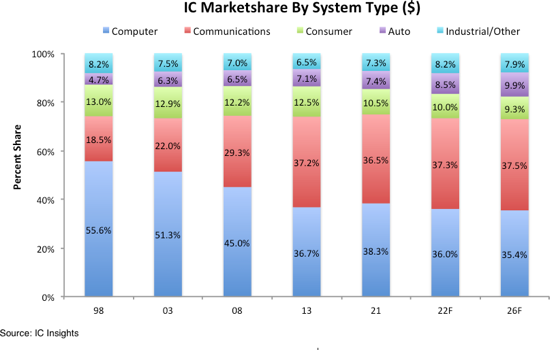

Figure 1 shows that the market share of automotive IC has grown steadily since 1998, from 4.7% of the total IC sales in that year to 7.4% in 2021. The market share of the automotive sector will continue to grow in the future, and is expected to reach 8.5% this year and 9.9% by 2026. At the core of this growth is the integration of a large number of new sensors, analog devices, controllers and optoelectronic devices into most new vehicles. In addition, the growth of global hybrid and all electric vehicle sales is driving this forecast growth.

Figure 1 Proportion of downstream market demand of semiconductor IC

Source: IC Insights

In addition, in a report released by Automotive News, the rapid growth of electric vehicle sales in the first three months of 2022 has made the share of electric vehicles in new vehicle sales in the United States reach about 5%. Of the approximately 250 million cars and light trucks in the United States, it is estimated that only 1% are electric, but user interest and sales will continue to grow.

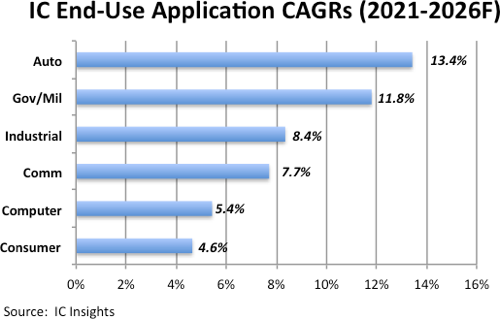

These factors are expected to lead to the highest CAGR of 13.4% in any major end use sector of the automotive market from 2021-2026 (Figure 2). However, given its relatively small size, the high growth in the automotive IC industry is not expected to significantly increase the growth rate of the entire IC industry in the next five years.

Figure 2 Prediction of Annual Compound Growth Rate of Semiconductor IC Terminal Application (2021-2026)

Source: IC Insights

By the end of August, Canalys, a market research institution, had shown that in the second quarter of 2022, the shipment of personal computers (including desktops, laptops and workstations) in mainland China was 11.485 million, down 16% year on year. Desktop computers (including desktop workstations) and laptops (including mobile workstations) decreased by 26% and 10% respectively.

On the other hand, in the case of economic downturn and production interruption, both the consumer and commercial sectors were affected by weak demand, resulting in a 19% and 13% drop in shipments in the second quarter.

Source: Canalys

In this regard, Canalys analyst Emma Xu also said frankly that it was a difficult quarter for PC manufacturers, with a market decline of up to 16%, the worst decline in nine years. Due to strict epidemic control measures, consumer and commercial demand have been hit hard. In the commercial sector, large enterprises saw the largest decline.

In fact, the weakness of consumer terminals also fed back to the upstream chip link early. According to the latest news from foreign media, insiders said that the price of NAND flash memory will further decline in the second half of 2022, because suppliers are under increasing pressure to deal with excess inventory.

It is reported that NAND flash memory chip suppliers are now facing four to five months of inventory. In the second half of this year, chip prices will fall rapidly, with a quarterly price drop of nearly 20%. Crucially, the price of NAND flash memory may continue to decline in the first half of 2023. At present, suppliers are becoming cautious about the demand for data centers, and the overall demand of the terminal market is still sluggish.

On the other hand, SSD inventory accumulates throughout the PC supply chain. Brand manufacturers such as ASUS Computer have kept their inventories high since the second quarter, and continue to adjust the orders of SSD and other components downward.

On the whole, as the editor reported earlier, at present, there is a rapid oversupply in the field of memory chips, personal computer processors and other chips, but at the same time, in the field of automotive chips, industrial chips and other fields, semiconductor manufacturers are still unable to meet customers and establish a stable chip supply.

Source: Network

In fact, according to the feedback from the media in Taiwan Province, the supply of automotive and industrial chips is still tight, while the inventory of consumer chips continues to accumulate in the entire supply chain.

It is reported that the inventory of consumer IC held by distributors and downstream equipment suppliers has reached an alarming level, and almost every link of the consumer IC industry is in a state of excess inventory.

In other words, in the best case, consumer IC suppliers may need half a year to complete inventory correction. Therefore, the prospect of consumer electronics demand in the second half of 2022 is generally pessimistic.

According to an industry source, Taiwan wafer foundry in China plans to keep prices flat in the second half of 2022, while orders for display driver IC and chips related to consumer electronics applications are cut.

Therefore, before that, Taiwan‘s indicator factories such as TSMC, Nanya Technology, Wenmao, Youda, Caijing, and Lijian Power all slowed down, and the investment of more than 150 billion yuan (Taiwan dollars) in total was facing a delay. In addition, Meguiar, SK Hynix and other major international factories also intended to slow down their investment, highlighting the cooling of the technology industry.

In retrospect, since the first half of the year, consumer electronics market demand has continued to weaken, and Samsung, Dell, LG and other large manufacturers have reduced their orders. On the other hand, the mismatch between supply and demand makes chip supply tight in the fields of automobile, industrial automation, AI big data, etc. The latest data shows that due to the shortage of chips, it is estimated that by the end of this year, the cumulative production reduction of global auto enterprises will climb to 3.8294 million units.

However, even so, there have been signs that the scope of semiconductor weakness is expanding. It is reported that Micron Technology industrial enterprises and automobile manufacturers have become the latest batch of customers to cut chip orders. However, it is still impossible to judge whether these customers were forced to reduce their orders because of the high purchase volume before or because their downstream customers‘ demand declined.

In other words, due to the complexity of the factors, it is difficult to analyze whether the current semiconductor market is weak because of the continuous supply chain problems or because the demand of downstream customers has plummeted.

Of course, the latest news shows that the chip delivery date in August is further shortened, which means that the global chip shortage is further alleviated. However, some types of chips are still in shortage, and manufacturers such as Microchip and Infineon still have supply pressure. Since June this year, the chip delivery cycle has been shortened slightly, indicating that the gap between supply and demand in the market is narrowing. As of August, the chip delivery cycle has been shortened for the third consecutive month. In any case, if the chip delivery date can return to 10 to 14 weeks, it is a relatively healthy state.

|

Disclaimer: This article is transferred from other platforms and does not represent the views and positions of this site. If there is any infringement or objection, please contact us to delete it. thank you! |