The vehicle electronic parts are sold out! Those who earn a lot of money, the head gauge Tier1

Time:2022-10-21

Views:1642

Source: Core Bugs Author: Joey

Vehicle specification level chip refers to the car chip that fully meets all requirements of "vehicle specification certification" and has passed the certification of a third-party certification authority. Compared with consumer chips, car specification chips need to face a more demanding application environment, so their reliability and security requirements are extremely strict.

The mismatch between the supply and demand side and the confusion of the supply volume lead to the continuous lack of car cores, and the main control, power and drive chips of large factories are still the main force of the lack of cores

Since September 2020, under the influence of epidemic situation, demand and other multiple factors, the core shortage problem has continued to affect the production and manufacturing of vehicles, and chip supply in some fields has deteriorated.

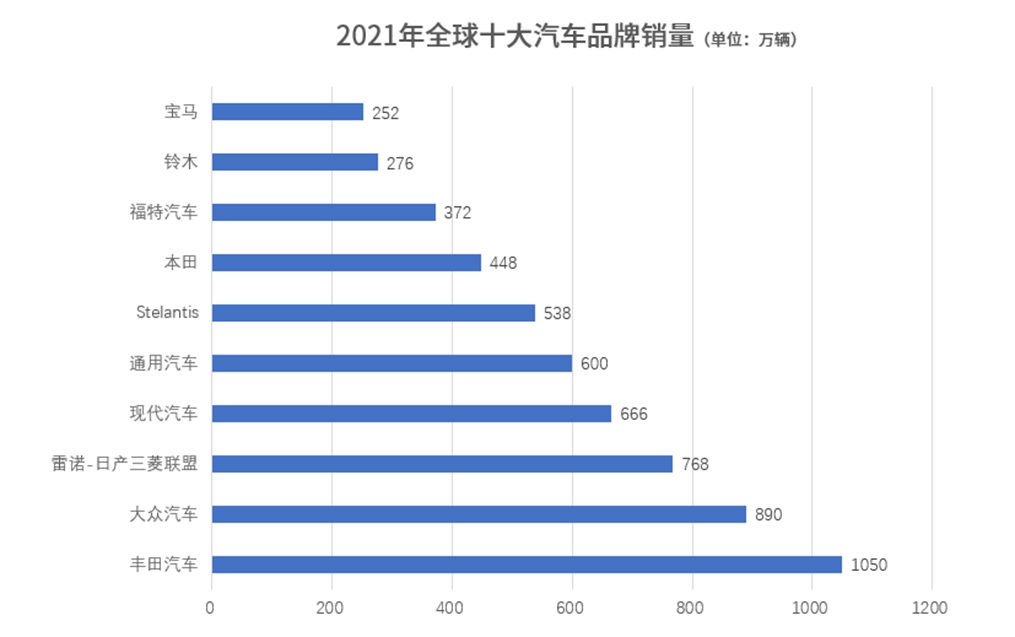

According to the data of the World Automobile Industry Association (OICA), the global total output of automobiles in 2021 will be about 80.15 million, an increase of 3% over the previous year. Although the sales volume has ended the three consecutive years of decline since 2018, in the past 2021, the global automobile market was hit hard by chip shortage, with a cumulative production reduction of more than 10 million vehicles, which is equivalent to the global sales volume of the entire Toyota Group in 2021 (10.5 million vehicles).

This year, according to the latest data of AFS, as of October 9, due to the shortage of chips, the global auto market has reduced the production of about 3.5371 million cars this year. AFS predicts that the cumulative production reduction in the global auto market will climb to 4.3635 million by the end of this year.

From the perspective of the reasons for the lack of core in the automotive industry, it is mainly due to the imbalance between supply and demand and the drawbacks of industrial chain stratification, which lead to the chaos of supply chain management.

On the supply side, the global investment in auto chip capacity is relatively conservative. At present, car chips account for about 10% of the total sales of the global semiconductor market, which is not high. Taking TSMC, the world‘s largest wafer foundry, as an example, the car chip business accounts for almost no more than 5% of its total business. Moreover, compared with consumer electronics, the gross profit margin of vehicle mounted chips is low, and the technical requirements are strict, so the OEM is not willing in this field.

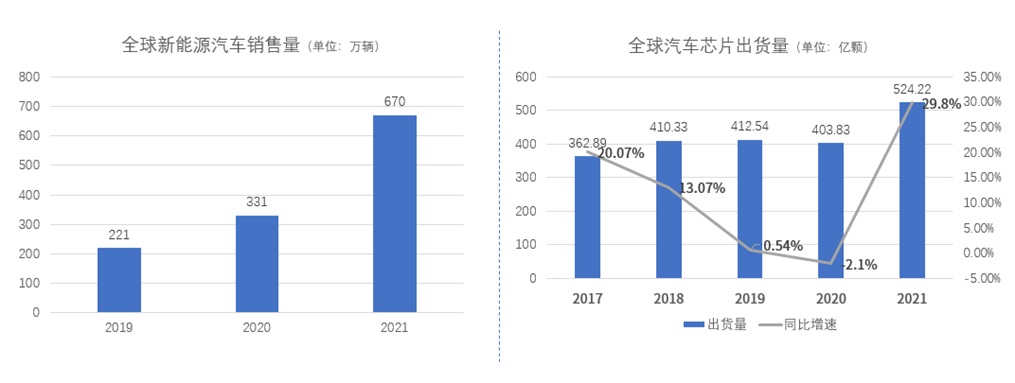

On the demand side, due to the downturn of the automobile market before 2020, car manufacturers and Tier1 have very low expectations for chip demand. However, with the outbreak of the new energy automobile market, the contradiction between supply and demand has begun to highlight. According to the data of IC Insights, the global automobile chip shipment in 2021 will reach 52.4 billion, with a year-on-year growth of nearly 30%. Compared with the downturn in previous years, it can be said that it is much more than expected.

Global automobile shipments in 2021 exceed expectations

Source: IC Insiggts

In addition to the supply and demand side, problems such as obvious stratification, insufficient flexibility and poor communication in the automotive chip supply chain are emerging. Industry insiders pointed out: "Semiconductor suppliers (Tier2) The chip is sold to Tier1, and then Tier1 integrates the function into the module and delivers the system integration scheme to the OEM for assembly and delivery to the vehicle factory. This mode makes Tier1 unable to accurately grasp the needs of vehicle manufacturers and Tier2 unable to make production capacity planning. At the end of 2020 and the beginning of 2021, car manufacturers have begun to feel the recovery of the car market. However, due to the hierarchical relationship of the supply chain, car manufacturers and semiconductor manufacturers have not achieved effective communication and coordination, which has exacerbated the chip supply gap to a certain extent. "

At present, the main categories of car gauge chips with missing cores include master control chip MCU, power supply chip and drive chip, which together account for 74% of the car gauge chips with missing cores, followed by signal chain chips, CAN/LIN and other communication chips; In terms of manufacturers, the lack of cores mainly comes from traditional automobile chip enterprises such as NXP, Texas Instruments, Infineon, and Italian French Semiconductor. On the whole, more than 70% of the lack of cores comes from the above four companies; According to the distribution of the producing areas of core deficiency, 77% of the cores are from Southeast Asia and the United States, mainly because of the serious epidemic situation in Southeast Asia and the United States. Other countries, including Japan and Europe, are facing core deficiency.

The continuous lack of core has a profound impact on the entire industry chain, or will accelerate the reconstruction of the century old automobile industry chain

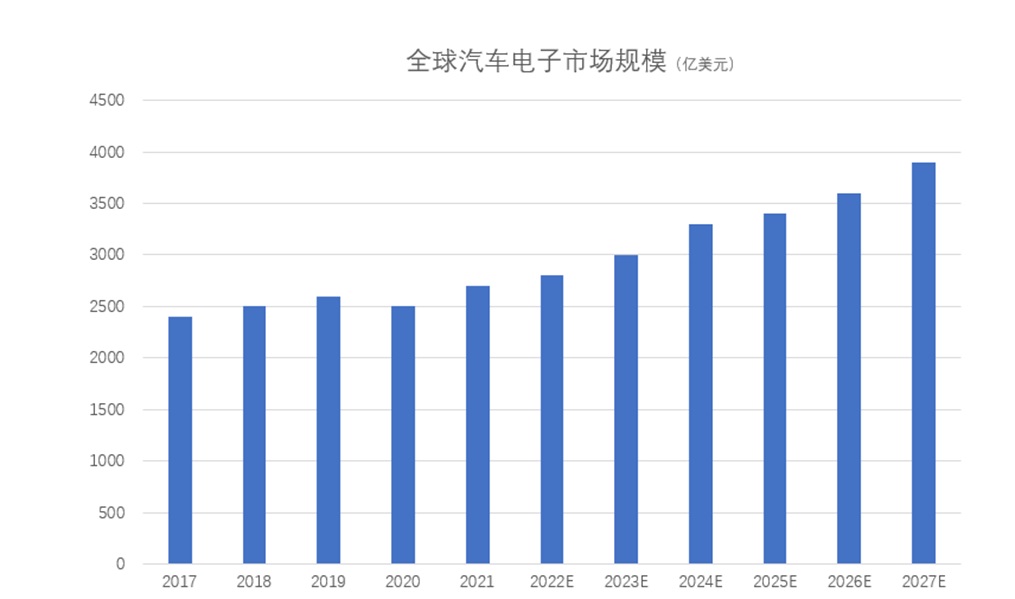

The market size of automobile electronics is trillion yuan, and the continuous lack of core has had a profound impact on the entire industrial chain.

According to the data of Huawei HiSilicon, the global automotive electronics market in 2021 will be about $270 billion, with a compound annual growth rate of nearly 7% in the next six years. It is estimated that the overall market size of automotive electronic components will be close to $400 billion by 2027. From the data, the growth rate of electronic components has exceeded the growth rate of the automobile market, and the electronic rate continues to increase.

Source: Huawei HiSilicon

In terms of semiconductor, the global automotive semiconductor market will be about US $50.5 billion in 2021. It is estimated that the total automotive semiconductor market will be close to US $100 billion in 2027, and the growth rate will remain above 30% from 2022 to 2027. China‘s car borne semiconductor market has risen steadily, with about 100 billion yuan in 2020.

From the perspective of the industrial chain, the current car specification chips are mainly divided into upstream raw material suppliers, midstream Tier2, Tier1 component manufacturers and downstream vehicle manufacturers.

In terms of vehicle sales in 2021, Toyota, Volkswagen, Renault Nissan Mitsubishi Alliance, Hyundai, General Motors, Stellantis, Honda, Ford, Suzuki and BMW are among the top ten in global sales, among which Toyota, Volkswagen and Renault Nissan Mitsubishi Alliance, the top three, all have more than 7 million vehicles in specific sales.

Source: Core Bugs

In the case that the overall car core shortage has not been improved, the main car manufacturers have responded to the "core shortage" by means of production reduction, structural optimization, etc. In the first quarter of 2022, Ford, Volkswagen, Toyota, Honda, Nissan and other auto enterprises have planned to reduce or stop production. Among them, Ford took temporary shutdown or production reduction measures against 8 factories in the United States, Mexico and Canada; Some car manufacturers, such as Great Wall, have taken structural optimization measures and suspended the order of middle and low-end models to ensure the supply of high-end models.

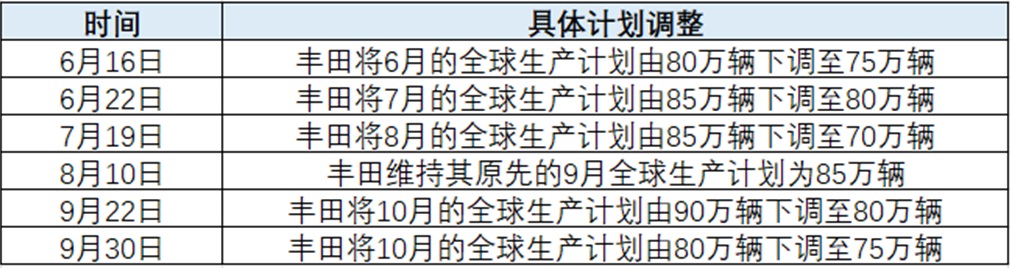

Recently, Toyota Motor said that due to the shortage of semiconductors, the company adjusted its global production plan for October again, reducing its output from about 800000 to about 750000. It is worth mentioning that this is the second production plan adjustment of the company in the past month, and the cumulative adjustment quantity has decreased by 150000 compared with the original plan of 900000 vehicles; In addition to Toyota, Honda also said that it would be forced to cut the output of its two Japanese plants this month. It is estimated that the production of the resident factory in Saitama Manufacturing Institute will be reduced by about 40%, and that in Suzuki Manufacturing Institute will be reduced by about 30%, because of the shortage of semiconductor and other components, the spread of the COVID-19 and the impact of logistics stagnation.

Toyota has cut its production plan several times recently

Source: Core Bugs

At the recent financial statement meeting, the relevant vehicle manufacturers all talked about their views on the lack of cores. Among them, Carlos Tavares, CEO of Stellantis, said that the chip shortage was expected to ease by the end of 2023, while Arno Antlitz, CFO of Volkswagen Group, predicted that the chip shortage would last until 2024.

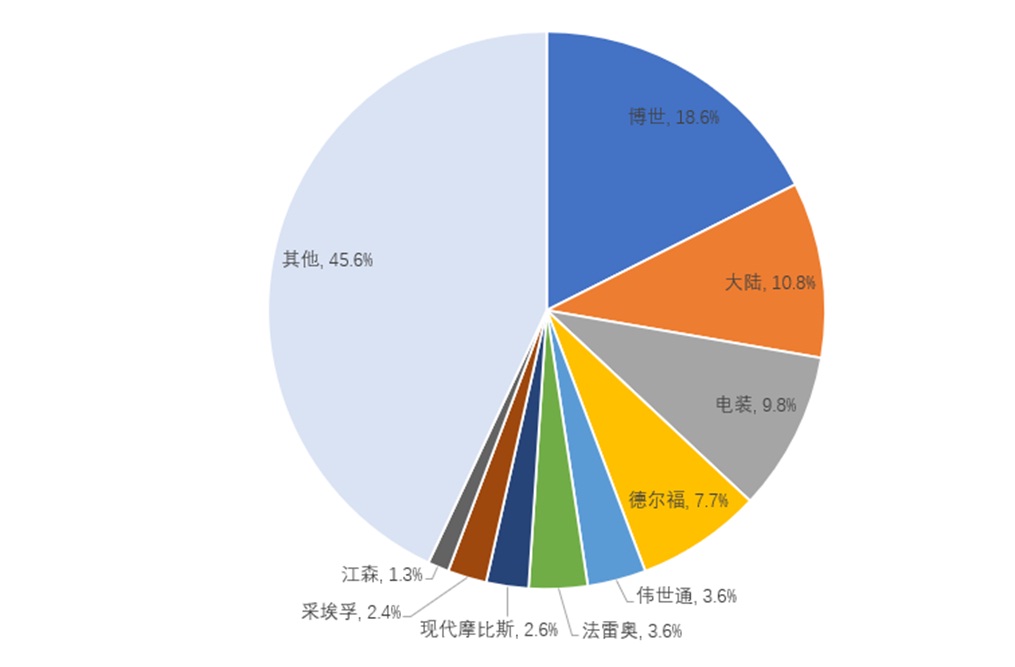

In the aspect of Tier 1, for a long time, international large automotive electronics enterprises such as Bosch, China, Japan Electronics, Delphi, Visidi, Valeo, etc. have taken the lead in the global automotive electronics market share by virtue of their advantages in technology accumulation, experience, etc., and the first six foreign automotive electronics primary suppliers have occupied 52.1% of the global automotive electronics market share.

The competition pattern of global automobile Tier 1 in 2020

Source: Core Bugs

From the perspective of its performance, in 2021, despite the impact of chip shortage, Tier 1 will make a lot of money in the adverse external environment.

According to the data of Gaishi Automobile, the revenue of 20 international mainstream parts enterprises will increase in varying degrees in 2021, and more than half of them will even achieve double-digit year-on-year growth. In terms of specific sales, there are four Tier 1 giants, Bosch, ZF, Continental and Magna International, whose revenues exceed 35 billion dollars. Another 7 enterprises have revenues between 10 billion and 20 billion dollars, led by Lear and Valeo. The revenue of the remaining nine enterprises is between 1 billion and 10 billion dollars, with Jingtai at the end. It can be seen from the financial report data that the market concentration of Tier 1 manufacturers is high, and there is a trend of two-level differentiation. The gap between small manufacturers and the top ten manufacturers is growing.

In terms of Tier 2, international semiconductor manufacturers such as Infineon, NXP, Rexa Electronics, Italy France Semiconductor, Texas Instruments, etc., take the lead in the global automotive electronics market share by virtue of their long-term technological advantages in the semiconductor field. According to SI data, the top ten semiconductor manufacturers account for about 50% of the secondary suppliers of automotive electronics.

Sales and market share of the world‘s top ten car gauge chip manufacturers (unit: 100 million US dollars)

Source: Core Bugs

From the perspective of sales in 2021, thanks to the influence of the overall price rise of the chip shortage, most auto semiconductor manufacturers‘ operating revenues hit a new record high. Among them, Infineon ranked first in the sales volume of Tier with its auto semiconductor revenue of $5.725 billion, and its market share was 8.3%. NXP and Renesa Electronics ranked second and third with US $5.493 billion and US $4.21 billion respectively, with market shares of 8% and 6.1% respectively. It is worth mentioning that the top three manufacturers are mainly engaged in automotive semiconductor business, accounting for nearly half of the total sales.

It is worth emphasizing that in addition to disclosing their performance, the major auto semiconductor enterprises also expressed their views on the current auto market at the financial statement presentation meeting. Most of these manufacturers said that the current car chip inventory is still lower than the normal level, and the car core shortage situation is still difficult to ease in the short term. In addition, in order to cope with the continuous shortage of capacity, major enterprises plan to increase capital expenditure to expand capacity.

Previously, Renesa Electronics announced that it planned to increase the capacity of on-board MCU by more than 50% by 2023. Among them, the supply capacity of high-end MCU has increased by 50% to about 40000 pieces per month. The capacity of low-end MCU will be increased by 70% to 30000 pieces per month. At present, Renesa occupies about 30% of the market share of automotive MCU, and its capacity expansion will greatly alleviate the shortage of automotive MCU; Infineon previously said that its capital expenditure in 2022 would be 2.3 billion US dollars, and it would expand its production with 50% annual large investment in the next two years; It is estimated that in 2022, the capital expenditure of Ansome will reach 935 million US dollars, with an increase of 110%, which is mainly used to expand the capacity of 300 mm wafers and the SiC supply chain. Its Sic capacity in the next five years will be 1.3 times that of today. On August 12, the silicon carbide factory in New Hampshire was completed. By the end of 22 years, the SiC substrate production capacity could be increased five times year on year. Other manufacturers, such as Texas Instruments, NXP, Italy France Semiconductor, have also announced production expansion plans to alleviate the shortage of automobile production capacity.

As for the phenomenon of auto chip manufacturers expanding their production, Sun Changxu of Xiaomi Industry Investment said: "Production expansion can solve the problem of chip shortage to a certain extent, but it is not a fundamental solution. I think the root of the solution lies in the car factory directly making predictions to the chip supplier and stabilizing the purchase order, so as to change the chaotic appearance of the supply chain management of automotive chips. This depends on the rise of new car making forces like Weixiaoli and Xiaomi. After the new situation appears, the car factory directly orders from the chip supplier to simplify the supply chain This order will be stable. So I think that the process will be completed in 2023 or around 2024, which has nothing to do with capacity, but is caused by management confusion. "

The overall self-sufficiency rate of China‘s auto chips is less than 5%, and domestic auto chip manufacturers may welcome the best development opportunities

The expansion cycle of automobile chips is long, and it is difficult to release production capacity quickly in the short term. With the strong demand for chips from the trend of automobile intelligence, the supply and demand of automobile chips will remain tense for a long time. In this context, in order to strengthen the reserve of production capacity and resources, domestic automobile manufacturers will vigorously promote the localization of vehicle specification level chips, and domestic automobile chip manufacturers are expected to welcome historic development opportunities.

According to relevant data, the overall self-sufficiency rate of China‘s automobile chips is less than 5%. Among them, the autonomy rate of automotive computing and control chips is less than 1%, that of sensors is 4%, that of power semiconductors is 8%, that of communication chips is 3%, and that of memories is 8%. In the future, driven by automobile intelligence and electrification, the total value of vehicle chips will continue to rise, and the domestic alternative market has huge space.

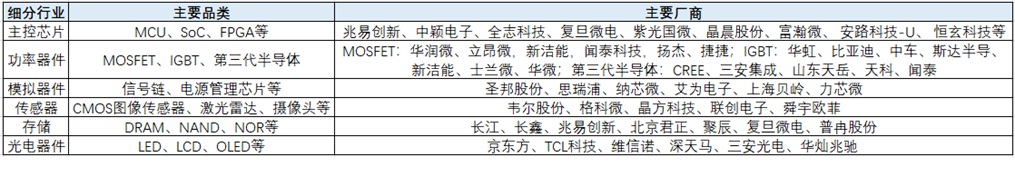

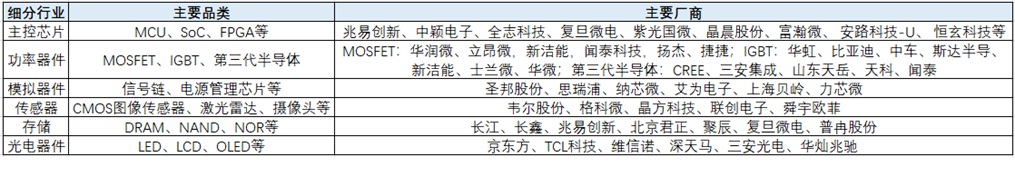

Major domestic car regulation chip manufacturers

Source: Core Bugs

In terms of master chips, computing power has been continuously improved with intelligence. From L1<1TOPS to L5 1000+TOPS, computing power has driven the rapid growth of master chips. In the field of intelligent cockpit chips, the evolution from electronic cockpit to the third living space will drive the penetration of MCU and SoC chips to increase, and the chip demand and iteration process will continue to accelerate. It is expected that Zhaoyi Innovation, Zhongying Electronics, Quanzhi Technology, Fudan Microelectronics, Ziguang Guowei, Jingchen Co., Ltd., Fuhan Microelectronics, Anlu Science-U and Hengxuan Technology will benefit from this; In the field of autopilot chips, in the future, autopilot chips will develop towards heterogeneous SoC integrated with "CPU+XPU" (XPU includes GPU/FPGA/ASIC, etc.). Companies such as Amlogic, Ruixin Microelectronics, Fuhan Microelectronics, Horizon, and Black Sesame will accelerate the layout of automotive SoC chips, which is expected to usher in a better development prospect.

In terms of power semiconductor, benefiting from the explosion of new energy vehicles, its value has increased by the largest margin. It is understood that the value of single fuel vehicle power semiconductor is only USD 87.6, while that of new energy vehicles is USD 458.7, an increase of more than four times. Among them, the IGBT field is just in need of new energy applications, and the chip is expected to grow rapidly, with a maximum value of 3900 yuan. Domestic manufacturers Huahong, BYD, CRRC Times, Stargate Semiconductors, New Jieneng, Slang Microelectronics and Hua Microelectronics are expected to welcome better development opportunities in the domestic substitution of IGBT; In the field of the third generation semiconductor SiC, with the continuous reduction of its cost and the continuous improvement of its yield, the advantages of physical performance and the demand for carbon neutralization, it is expected that SiC will meet the growth turning point in 2022 and will be fully rolled out in 2026. China‘s Wentai Technology, Dongwei Semiconductors, Silanwei, Times Electric, Star Semiconductors, San‘an Integration, Shandong Tianyue, Tianke Heda and other companies are all actively planning.

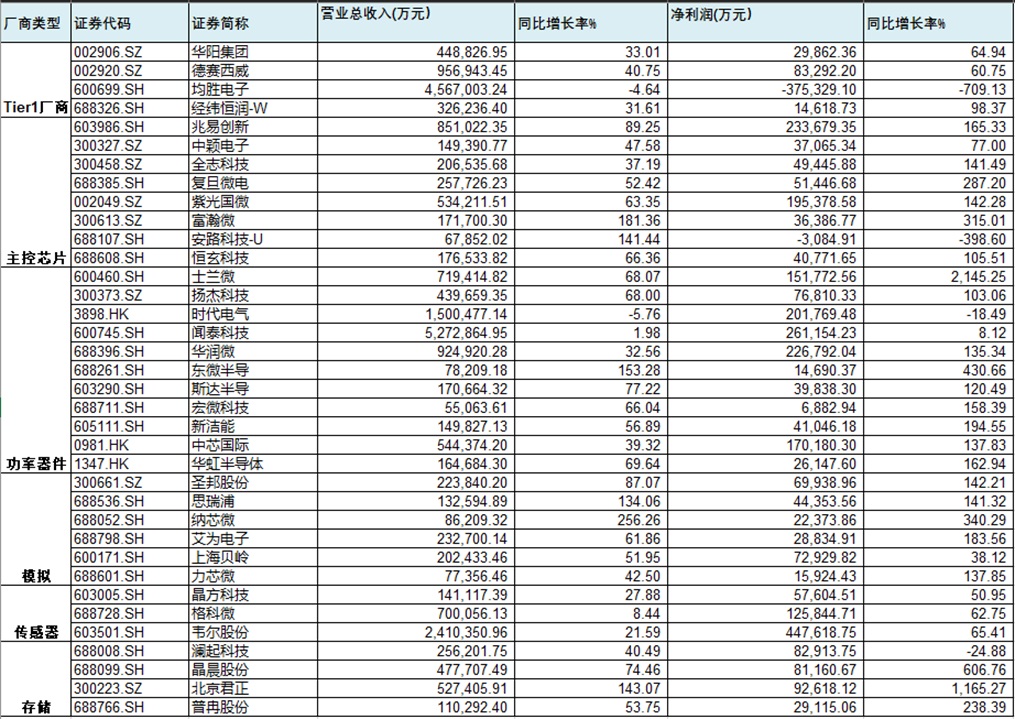

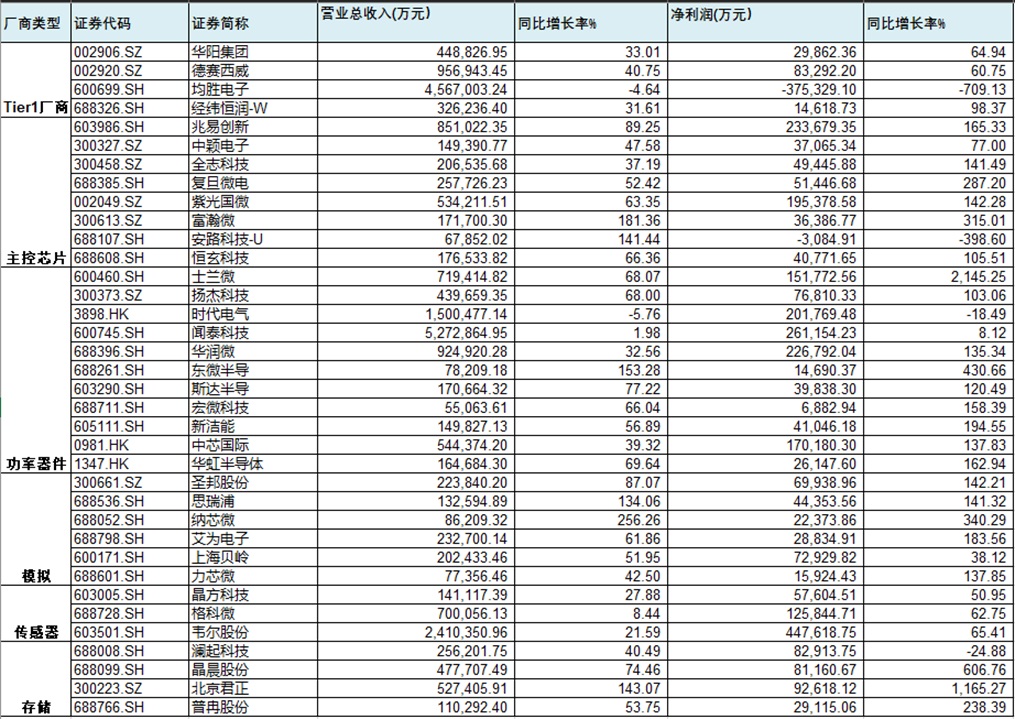

Performance of major domestic car regulation chip manufacturers in 2021

Source: wind

In terms of analog chips, it covers all major core sectors, including body, instrument, chassis, powertrain and ADAS. The value of a single car is $200, the highest in the downstream. Among them, the growth rate of CAGR in the field of power management reached 9%, and the proportion of car body and chassis reached 40%. China Resources Microenterprise, SAP, Simbond, Weir, Shilan Microenterprise and other enterprises have layout; The signal chain field is the cornerstone of intelligent automobile products, and the new four modernizations of automobiles will accelerate its growth. China Shengbang Corporation, SRIPP, China Resources Micro, Xinhai Technology, Juxun Semiconductor and other companies are expected to benefit from this.

In terms of sensors, L2 class cars are expected to carry 6 sensors worth about 160 dollars, and L5 class cars will be upgraded to 32 sensors worth 970 dollars. Among them, the fusion scheme of image sensor+millimeter wave radar+laser radar has become the mainstream, and the three are mutually compensated and redundant to ensure the safety of automatic driving. In the field of image sensors, Gekewei and Weir stock products have been widely used in the automotive market; In the field of lidar, manufacturers such as Hesai Technology, Sagitar Juchuang, Dajiang, Huawei, etc. currently have many cases where car manufacturers have been designated.

In terms of storage chips, the development of electrification, informatization, intelligence and networking will promote the automotive storage revolution, which will move from gigabit level to terabyte level. In the future, automobiles will become the core factor for the memory to enter the 100 billion dollar market. The products of Beijing Junzheng, Zhaoyi Innovation, Fudan Microelectronics, Puran, Juchen, Jiangbolong, Baiwei Storage and other companies have passed the certification of vehicle regulations, and are gradually introduced into the vehicle market.

In the future, with the acceleration of the transformation of the new energy automobile industry, the original pyramid pattern of OEM+Tier1+Tier2 in the traditional automobile industry is expected to be broken, and gradually move to the platform+ecological model. From the leading development of the automobile factory to the leading development of enterprises that master the key links of core technology, the continuous extension of the automobile core shortage delivery cycle will accelerate the domestic substitution. China‘s automobile chip manufacturers will welcome the best development opportunity in the automobile industry in the past century.

Write at the end

Under the trend of "new four modernizations" of automobiles, it will drive the value reconstruction of the overall industrial chain, and the content and importance of automobile chips will increase exponentially. It is estimated that the proportion of automobile semiconductors in the total cost of automobiles will reach 50% in 2030, which will become a new profit growth point for automobiles.

The supply side is still under great pressure in the face of the doubled demand for chips for new energy vehicles. Although mainstream chip manufacturers have all announced to increase capital expenditure and expand production substantially, as the cycle of on-board chips from capacity construction to production and finally to vehicle launch is very long, the capacity of current expansion can only be released after 2023. Therefore, this wave of car core shortage is expected to last until 2023-2024. Under the situation that the production capacity of international large factories cannot meet the demand, China‘s chip manufacturers that have worked in the field of automobile chips earlier are expected to usher in leapfrog development against this background.

|

Disclaimer: This article is transferred from other platforms and does not represent the views and positions of this site. If there is any infringement or objection, please contact us to delete it. thank you! |