newest! The supply shortage of automotive semiconductors alleviates the problem that the delivery time of vehicles is shortening

Time:2023-02-06

Views:1260

Introduction: After the extreme shortage and price increase, the supply and demand of automotive chips has entered a new adjustment period. Recently, the debate on whether the automotive semiconductor is out of stock has become a hot topic. The current consensus in the industry is that some chips are no longer in shortage, but the structural shortage still exists.

A few days ago, according to Yonhap news agency, the industry believes that the easing of supply and demand of automotive semiconductors is normalizing supply and reducing vehicle delivery cycle. Among them, the delivery period of vehicles of Hyundai, Kia and other large Korean auto companies has been shortened by 1-8 months compared with the previous month.

From the automobile data, the supply chain stagnation caused by lack of core has been alleviated. According to the previous data of Qunzi Consulting, the global car sales in 2022 is expected to be about 80.8 million, down about 0.2% year on year, but the growth rate in the second half of the year is obvious, reaching 10.7% year on year. At the same time, the reduction of car production caused by lack of cores in the past period is gradually easing. It is estimated that the global car sales will reach 82.7 million units in 2023, with a year-on-year increase of about 2.4%.

In addition, according to several people in the semiconductor industry chain, automotive semiconductors have generally eased, but some segments are still short of supply, such as silicon carbide, MOSFET, etc., and their production time is relatively slow. At present, there is relatively no shortage of medium-low power semiconductors, MCUs and memory chips, but there is a relatively shortage of new functional products and high-order MCU, IGBT, ADAS, AI, sensors, and automotive DDI-related chips.

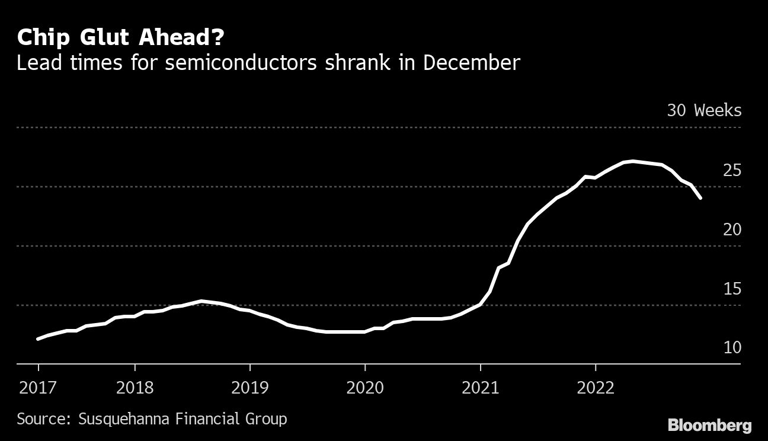

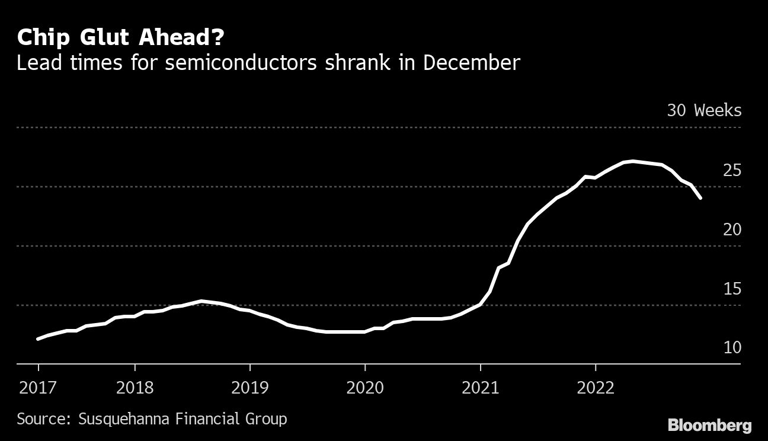

On the other hand, the latest data of Susquehanna Financial Group shows that since June 2022, the average global chip delivery cycle (the cycle from ordering to delivery) has maintained a downward trend, and the chip delivery time is also accelerating. Susquehanna‘s latest research shows that in December last year, the average global chip delivery cycle was about 24 weeks, 8 days shorter.

Source: Bloomberg

Susquehanna‘s report shows that in December last year, Infineon, the main chip supplier of automobile manufacturers, reduced the delivery time by 23 days, and microchip technology by 24 days. The delivery time of Texas Instruments, which has the largest chip product series and customer list, has also been shortened, with 25 days and 4 weeks in October and December respectively. Nevertheless, the supply of some automotive chips of Texas Instruments in October is still limited.

Christopher Rolland, an analyst at Susquehanna, said that the delivery time of chips had improved from the peak, and the worst time of supply shock had also passed. The delivery time of all product categories had been shortened in December last year. 70% of the companies surveyed by Susquehanna also said last October that they could supply chips more quickly.

The data shows that with the arrival of the era of new energy vehicles, the IC content of automobiles has directly increased from 3% to 30%, and the demand is still growing significantly. Enterprises will not miss new opportunities. In this year‘s exhibition, domestic semiconductor upstream and downstream enterprises must mention the high-frequency word "vehicle use". Some enterprises even take the "AII in" strategy to bet on the new energy track. However, the threshold of the car level competition is not low. While taking advantage of new energy to break through the original supply chain, domestic enterprises are also making great efforts in technology research and development.

After all, a few days ago, the German Automobile Industry Association (VDA) specially warned that if the supply shortage of semiconductor parts continues, the number of cars leaving the world will be reduced by up to 20% by 2026. Therefore, the European Union is called upon to give special support to automotive related semiconductors.

VDA pointed out that by 2030, the demand for semiconductor zero in the automotive industry will be twice as high as the current one, 1.8 times higher than the growth of the global semiconductor market demand. In particular, 90 nanometers and more mature semiconductors are still important for the automotive industry. At present, less than 20% of the capital expenditure will be used for the node manufacturing process of 65nm or more mature nodes, which is far from enough for the future demand of semiconductors in the automobile industry.

However, it is also believed that due to the decline in terminal demand, downstream manufacturers will begin to implement the de-inventory strategy in the second half of 2022, and the utilization rate of mature process capacity of wafer fabs will further decline in the fourth quarter, and the OEM price will continue to decline. At present, most of the car gauge products still adopt mature manufacturing process, and the price will inevitably loosen in the next period of time, so the car chip market will enter a stable period.

|

Disclaimer: This article is transferred from other platforms and does not represent the views and positions of this site. If there is any infringement or objection, please contact us to delete it. thank you! |