According to the news, Samsung took the lead in launching the price war for wafer OEM, and Liandian and the world‘s advanced companies were forced to reduce the price to fight

Time:2023-02-15

Views:1232

Source: IT Home Author: Wen Zhou

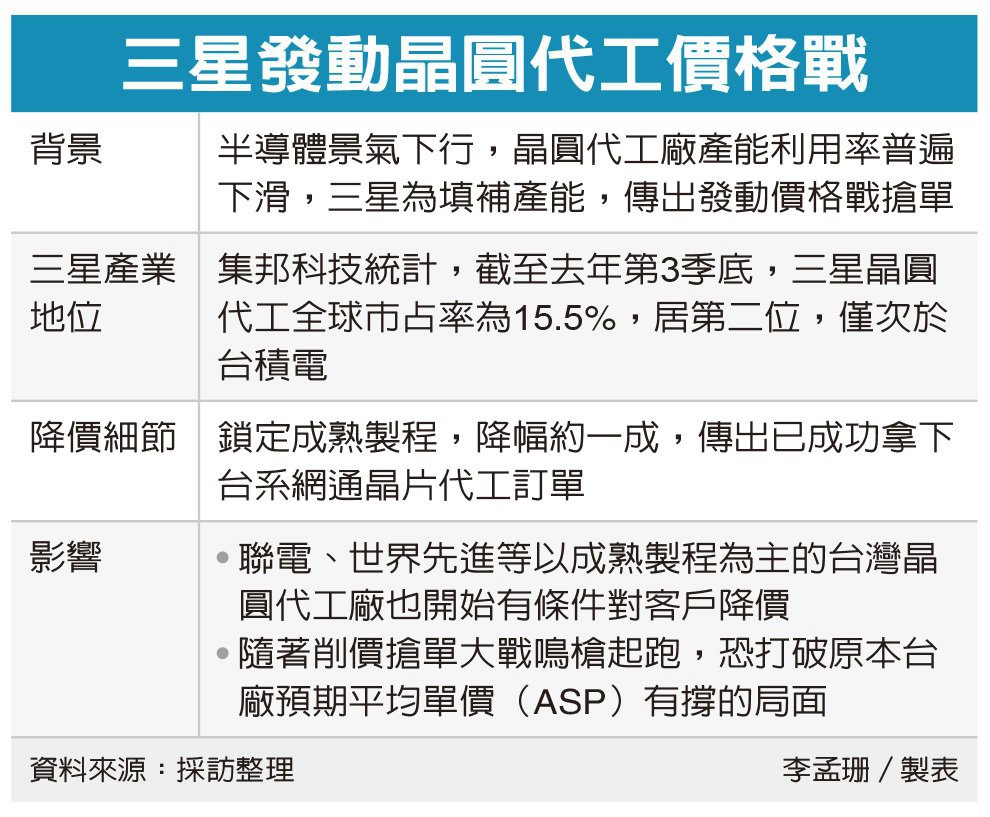

On February 13, South Korean media reported that in response to the downturn in the semiconductor market, Samsung‘s wafer foundry business plans to adopt the strategy of "attacking high-end and abandoning mature", and transfer the personnel of the mature process production line to the high-end production line to fully sprint 3nm production, and even give up the key customers under the mature process, but Samsung subsequently issued a statement denying.

In this case, the industry again reported that Samsung not only did not give up the business of mature manufacturing process, but also offered a more powerful price war to seize orders, hoping to reverse the decline and obtain more orders to fill the capacity.

According to Taiwan Economic Daily, Samsung has launched a price war with other manufacturers in terms of OEM quotation, and the quotation for OEM of mature process has dropped by as much as 10%, and has successfully won some orders from Taiwan Netcom chip factories. After Samsung launched a price war, manufacturers such as Liandian and the world‘s leading manufacturers also began to offer price reductions to customers conditionally.

The latest survey by TrendForce, a technology market survey agency, shows that the global market share of Samsung wafer foundry was still 15.5% as of Q3 last year, ranking the second in the world. Although it has dropped significantly from the background power (56.1% market share), it has reached the third to fifth place of the three companies, namely Liandian, Grid Core and SMIC International.

According to the supply chain, Samsung‘s wafer foundry business was originally focused on the production of its own chips, but the current environment is in the adverse wind, and Samsung‘s demand for its own chips has been frustrated simultaneously, resulting in a large number of idle capacity. In order to fill the capacity gap, it is inevitable to haggle for orders.

The supply chain pointed out that the quotation of Samsung wafer OEM was originally slightly lower than that of its peers. Now if it is cut by another 10%, it will become a means for those customers to force the original partners to reduce the price. Simply put, "If you don‘t reduce the price, I will go to Samsung for production", which makes the wafer foundry industry face common pressure.

In response, Liandian said that the order visibility at the current stage is low, and this quarter is full of multiple challenges. The capacity utilization rate will drop from 90% in the previous quarter to nearly 70%. The gross profit rate and the wafer shipment volume will decrease sharply at the same time. The gross profit rate may drop to the lowest point in nearly seven quarters, but the demand is expected to gradually return in the second half of the year.

|

Disclaimer: This article is transferred from other platforms and does not represent the views and positions of this site. If there is any infringement or objection, please contact us to delete it. thank you! |