New terminal consumer electronics in the semiconductor incremental market in 2023

Time:2023-03-07

Views:1161

Source: Core myna Author: Aileen

As we all know, in the past three years, due to the epidemic situation, combined with factors such as geo-economic friction, macroeconomic downturn and decline in consumer willingness, the global consumer electronics market has been continuously impacted, and the mainstream consumer electronics products such as PCs, tablets, smart phones and smart televisions have been in a state of decline, and the market has shrunk significantly. After the boom in 2021 and the cooling in 2022, and entering 2023, the new consumer electronics market still presents many bright spots worth looking forward to.

Household consumer-grade robot: It is expected to become a new race track to sea in 2023

Since 2021, there has been a trend of intelligent home appliances at sea. Since the second half of 2022, the new segment of consumer robots and pet care market (including automatic cat litter pots, pet hair trimmers, etc.) has ushered in an outbreak. Under this trend, the investment and financing events of consumer-grade robots have increased significantly in the past year, and robots have extended from the floor to more scenes, such as lawn mowing, pool cleaning, and home patrolling, reflecting the obvious advantages of more interactive consumer-grade robots in the industrial chain, which is expected to become an emerging race track to sea in 2023.

Lawn mowing and pool cleaning robots can be regarded as "inheritance" of sweeping robots to some extent. Due to labor costs, epidemic and other reasons, swimming pool robots in the European and American markets are growing rapidly. The shipment of swimming pool cleaning robots will reach more than 500000 in 2021 through the online channel in the United States alone, with a growth rate of more than 130%, belonging to the early stage of rapid growth. Foreign enterprises have launched swimming pool robot products many years ago, accounting for most of the market share. Traditional brands include Dolphin, Hayward, Polaris, etc. A domestic enterprise, Yuanding Intelligent, has received more than 100 million yuan of A-round financing in 22 years. The main target group is European and American residents with their own swimming pool. The main product, Aiper swimming pool robot, has maintained a growth of more than 200%.

Ruichi Smart, which obtained financing last year, aims to put its target on the lawns of European and American residents. Its products mainly use laser radar+visual navigation mode, and make efforts in safety protection and other aspects. The main brand is the lawnmower robot brand, HonyMow. Similar to Aiper, HonyMow also uses the interaction of algorithms and apps to enable the robot to mow according to its own planning route. Whether the robot is placed in the swimming pool or on the grass, its technology is different, but it still belongs to the category of cleaning robots, but the more complex environment leads to greater technical challenges. In 2020, the global market size of mowing robots will reach 1.3 billion US dollars, and it is expected that the annual compound growth rate of the global market size of mowing robots will reach 12% in the period from 2019 to 2025. The growth rate of the mowing robot market will be significantly higher than the overall growth rate of the industry. In addition, the consumer-grade robot projects financed last year also include the home patrol robot brand Moorbot. After integrating machine vision, artificial intelligence, Internet of Things, cloud computing and other technologies, the market application of consumer robots in the future cannot be underestimated.

Source: sorting out by Myna Core

On the whole, bringing robots into more life scenes to replace the boring and repetitive work of human beings is a long-term goal. The global market has great potential on the eve of the outbreak. In recent years, China‘s consumer-grade robot brand has been expanding rapidly overseas. This fast-growing track will become the next opportunity for Chinese brands to go overseas.

Consumer-grade energy storage: driven by technology and demand

Under the background of epidemic factors, energy shortage in Europe and the United States in 2022, and rising prices of electricity, natural gas and crude oil, the market scale of consumer-grade energy storage products continues to expand, focusing on family and personal life scenarios. In 2022, consumer-grade energy storage products were the most popular in cross-border e-commerce, and the top projects were "robbed" crazily. Unlike industrial energy storage and power generation energy storage at the B end, consumer-grade energy storage includes portable energy storage, RV energy storage and household energy storage.

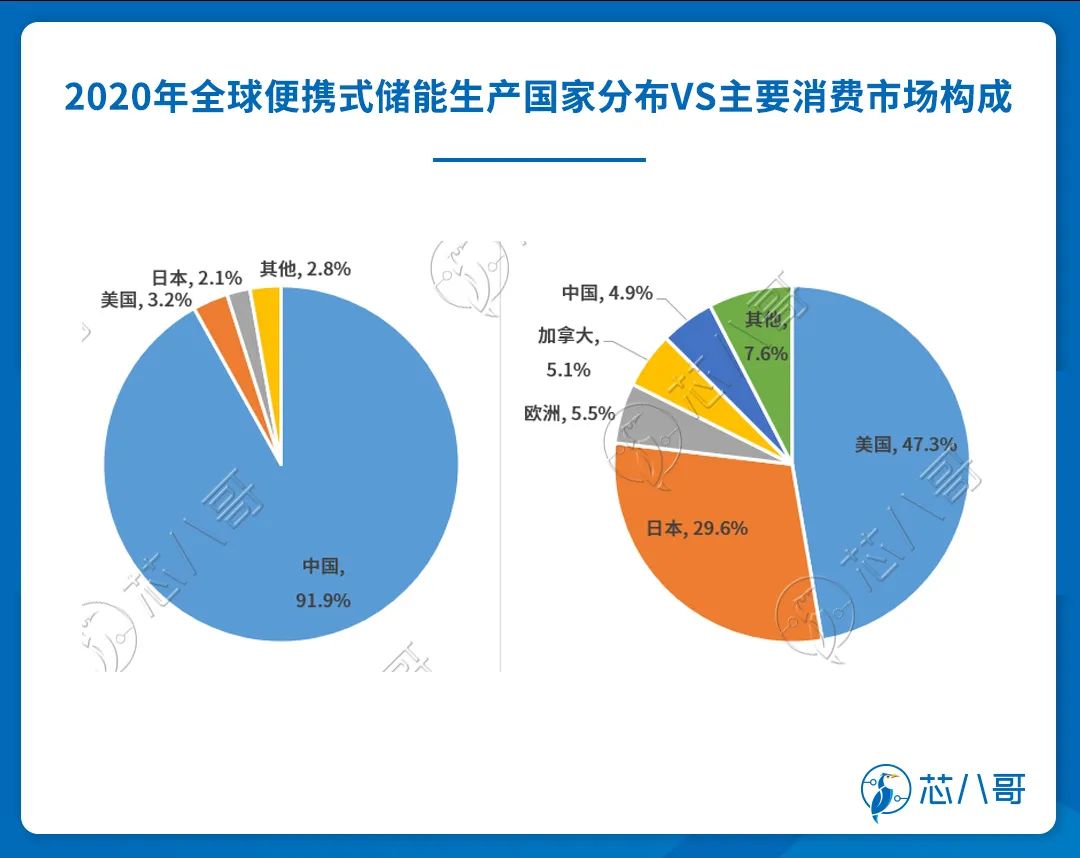

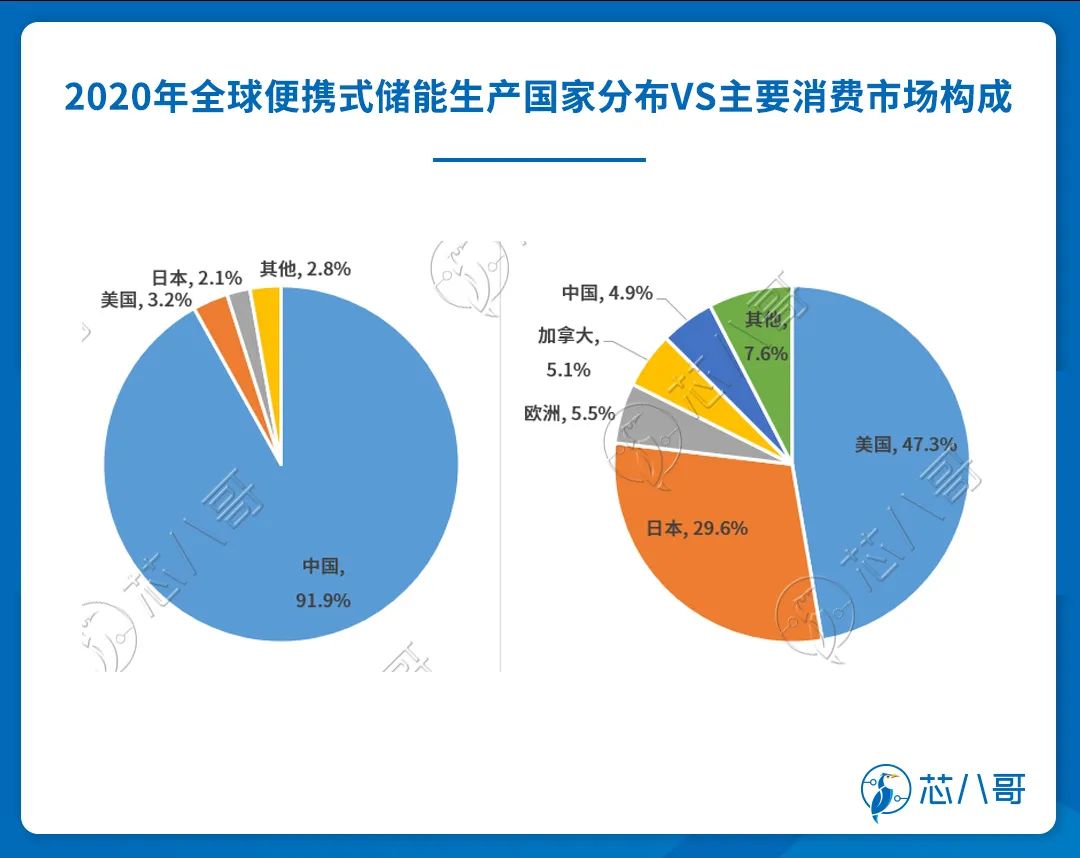

In terms of portable energy storage, in 2020, the output of China, the United States and Japan accounted for 91.9%, 3.2% and 2.1% respectively. According to the shipment volume, Huabao Xinneng accounted for 16.6%, Zhenghao Technology 6.3%, Goal Zero 5.6%, Telan Minghai 5.3% and Anke Innovation 2.2%. According to HIS statistics, in terms of household energy storage, based on the 2019 shipments of Tesla, LG Chemical and Pieneng Technology (independent brand), the market share was 15%, 11% and 8.5% respectively, of which the total of Pieneng Technology‘s independent brand+OEM accounted for 12.2%.

Source: Education source: China Chemical and Physical Electrical Velocity Industry Association

In the consumer-grade energy storage, the upstream materials are mainly composed of electric cells, BMS, EMS, electronic components, inverters, solar panels, etc., of which the battery accounts for about 60% of the total cost; In terms of brands, in terms of cross-border e-commerce, EcoFlow Zhenghao and Delan Minghai, which take the route of large capacity and high profit, and Huabao Xinneng and Anke Innovation, which mainly focus on small volume shipments, are the two leading enterprises; In terms of channels, online sales are the main business. With reference to the sales of Huabao Xinneng, online sales account for 87%, of which Amazon is the leading business (52% of revenue in 21 years), and independent stations are important supplements, accounting for 15% of revenue.

Consumer-grade energy storage industry chain

Source: sorting out by Myna Core

It is reported that China is the world‘s largest producer of portable energy storage equipment, accounting for more than 90% of the production and shipment. In 2021, the global sales of portable energy storage reached a new high, reaching 11.2 billion yuan. The Association predicts that the global market of this category will further increase to 88.23 billion yuan in 2026. GGII statistics show that the total shipments of lithium battery energy storage in China in 2021 will be 37GWh, of which portable energy storage will account for only 3% and household energy storage will account for 15%, which means that the output value of household energy storage will be at least 50 billion yuan last year. Liu Cong, head of overseas e-commerce business of Zhenghao EcoFlow, predicted that by 2027, the global RV energy storage market will reach 45 billion yuan and the household energy storage will exceed 100 billion yuan.

Source: China Chemical and Physical Power Industry Association

E-bike: 100 billion scale, capital accumulation

Under the background of rising oil prices and energy crisis, electric products have become a hot spot in the travel track. The most popular investment target is e-bike, that is, electric bicycle. It is based on the traditional bicycle, plus the battery as the auxiliary energy, and can realize the pure bicycle treading mode, pure electric mode, or treading electric power. The price is between $1000 and $3000. It is twice as fast as the ordinary bicycle, and it is more labor-saving to go uphill. It releases energy, while maintaining the pleasure of riding, and can enjoy the experience of farther mileage. The audience is mainly concentrated in developed countries in Europe and America. The logic of e-bike‘s popularity is mainly to step on the concept of "carbon neutrality+consumer electronics+short-distance electric travel+new energy" pursued by the capital market.

As a recognized "bicycle power", China has a complete supply chain system. With this part of "congenital advantage" gene, some domestic E-bike enterprises are moving towards overseas markets. For example, the domestic E-bike brand represented by TENWAYS and URTOPIA has taken the lead in the world. Among them, more famous foreign brands include VanMoof, Aventon, Pedego, etc. Driven by the demand of overseas markets, more and more domestic electric bicycle brands have emerged and attracted the attention of investors. According to the data of CVSource Investment Center, from July 2021 to the end of 2022, more than 20 two-wheel electric vehicle enterprises have obtained financing, and a number of capital such as Alibaba, Tencent and Hillhouse have begun to enter the market.

Source: sorting out by Myna Core

According to relevant data, from 2017 to 2021, the sales of E-bike in Europe and North America increased from 2.5 million to 6.4 million, an increase of 156% in four years. The penetration rate of E-bike in the United States reached 4% in 2021, while that in Europe was 20%. Allied Market Research, a market research institute, predicts that the global E-bike market will reach 118.6 billion US dollars by 2030, with a CAGR of more than 10%.

With large market scale, capital accumulation and large companies competing for layout, the sales volume of E-bike in Europe and America has exceeded that of electric vehicles and hybrid vehicles. Although it is not popular in China, the development momentum of E-bike in the European and American markets is far beyond our imagination. From the fact that the E-bike brand has obtained tens of millions or even hundreds of millions of financing, it can be seen that the development prospect of electric bicycle in the international market is self-evident.

VR/AR: The entry of giants and the rise of new talent

With the rise of the yuan universe, the recovery of capital and the improvement of terminal acceptance of wearable devices, VR/AR of the segmented track shows a trend of rapid growth, and is expected to usher in a larger scale of development in the next five years. The industry drivers are mainly hardware technology upgrading iteration, quantitative change driving the release of scale effect, rapid development of content application, and continuous active investment and financing.

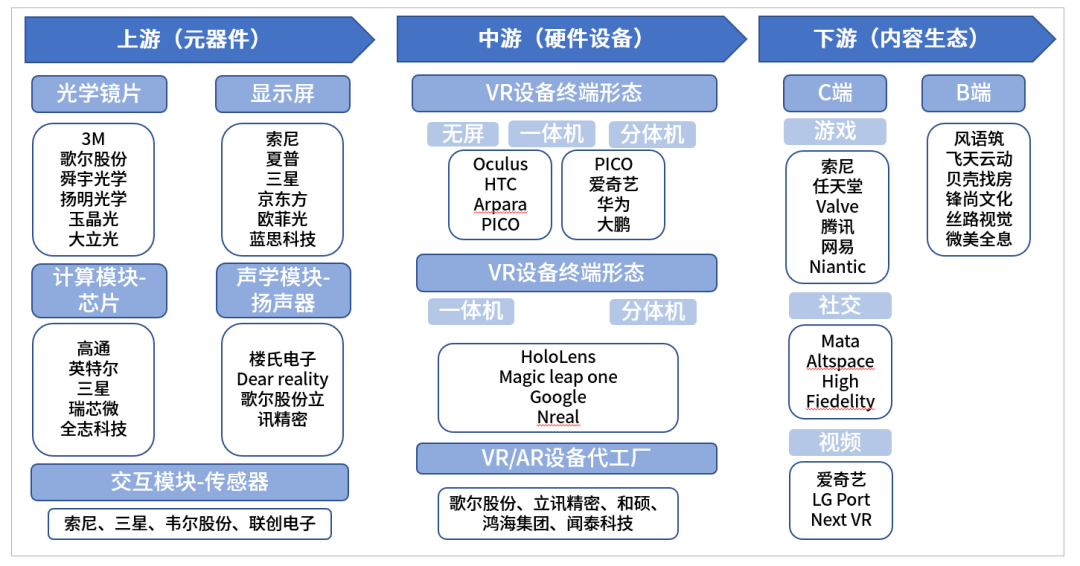

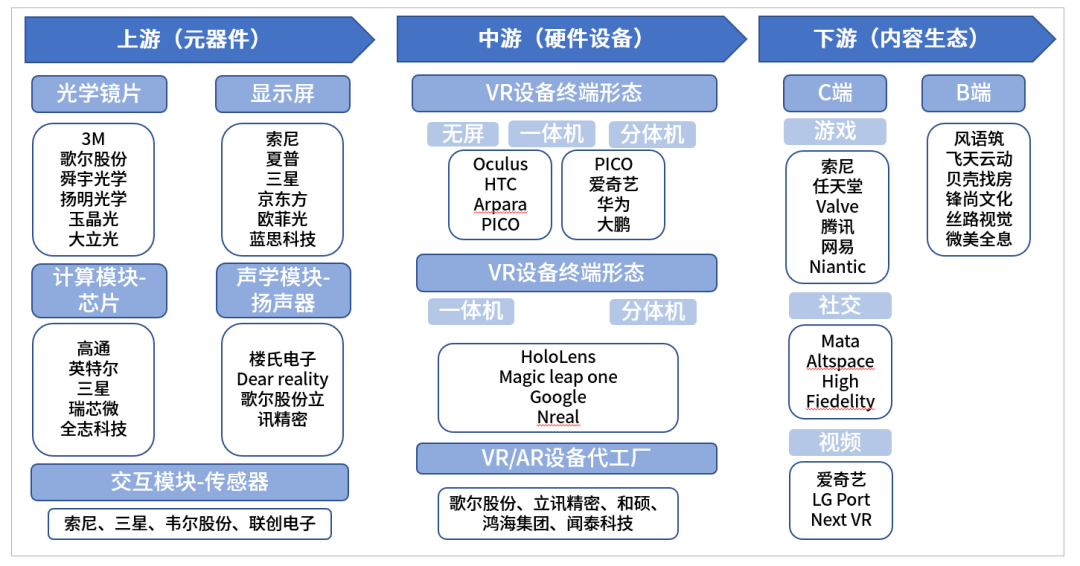

As far as the VR/AR industry chain is concerned, the chip cost accounts for the highest proportion. The upstream of VR/AR is mainly core devices, including chips, display screens, optical devices, sensors, etc. The midstream is mainly about the form of equipment terminals and factories. Downstream are mainly end users of games, social networking, video, enterprises, etc. Among them, the chip cost accounts for the highest proportion, with Qualcomm Snapdragon as the main part. Taking MetaQuest 2 as an example, its BOM cost is about $299, of which the chip cost is $135-150, accounting for up to 50%; The optical components are 18-30 dollars, accounting for 6-10%; Display screen is 60-75 dollars, accounting for about 20-25%; Other parts account for 10-15%; The total machine assembly is USD 9-15, accounting for 3-5%.

Overview of VR/AR industry chain

Source: sorting out by Myna Core

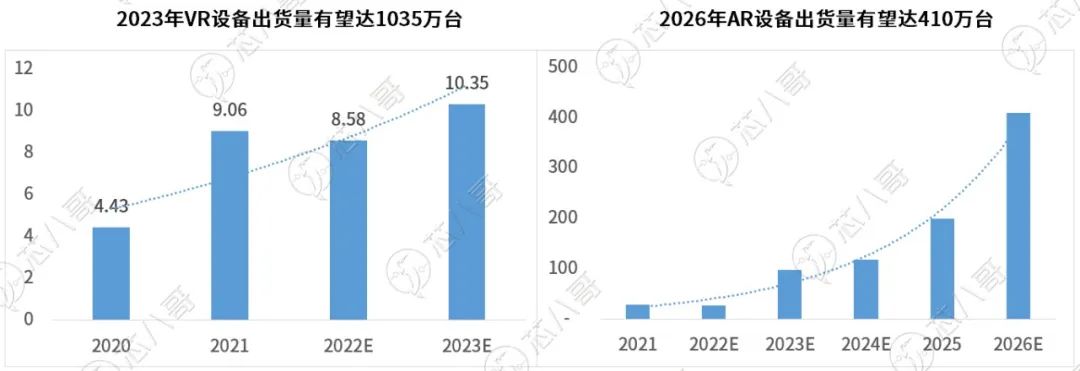

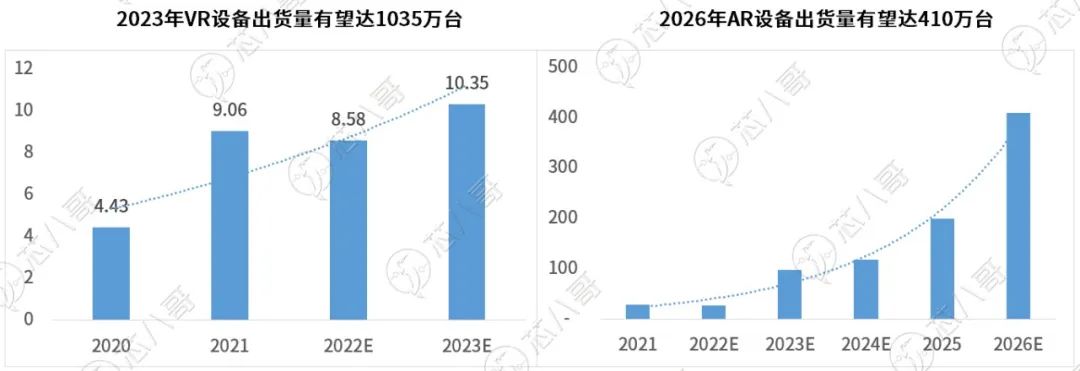

From 2020 to 2021, the volume of VR increased at a high speed, and the growth rate of the shipment volume in 2022 slowed down due to the product cycle and macroeconomic impact. However, from the current situation of its hardware, application and capital, it is predicted that VR/AR will remain optimistic in the medium and long term, and the performance improvement of the hardware side will bring better experience, and the mature industrial chain will realize more supply; On the content side, richness and application scenario expansion will bring stronger demand; At the capital end, VR/AR manufacturers have chosen the road of "burning money" to expand user scale, which has also been favored by the capital in recent years. According to VR gyro statistics, the total investment and financing of the global VR/AR industry in the first half of 2022 was 31.26 billion yuan, compared with 22.82 billion yuan in the same period of 2021, up 37% year on year. In terms of the number of financing M&A events, 172 financing M&A cases occurred in VR/AR globally in 2022, an increase of 16% over the same period in 2021.

According to the latest report of TrendForce Chibang Consulting, it is estimated that the global VR device shipments will be about 8.58 million in 2022, with an annual decrease of 5.3%. The main reasons for the reduction were the impact of high inflation on the consumption strength of the end market, the delay or failure of brand manufacturers to launch new products, and the adjustment of Meta‘s pricing strategy. Thanks to the launch of Sony PS VR2, Meta Quest 3 and other new products, it is expected that the shipment volume of VR devices will rise to 10.35 million units in 2023, with an annual increase of 20.6%. Among them, the shipment volume of Oculus Quest series in 2023 will be about 7.25 million units. Sony and Pico also continue to make efforts in the VR market. In 2022, the global shipment of AR equipment was 260000, down 8.7% year on year. As more and more companies enter the AR market, technology giants such as Apple and Meta have also begun to enter the AR-related fields. IDC predicts that the shipment volume of AR equipment will reach 4.1 million in 2026, and the CAGR will reach 70.3% in 22-26.

Source: Sorted by TrendForce, IDC and Myna Core

At present, the AR/VR industry is in a critical period of development, and the new growth point will be the key for the AR/VR industry to enter the C-end and B-end markets. Under the concept of "meta universe", AR/VR, as the key entrance to the meta universe, will play a key role in the process of integrating the meta universe with various industries.

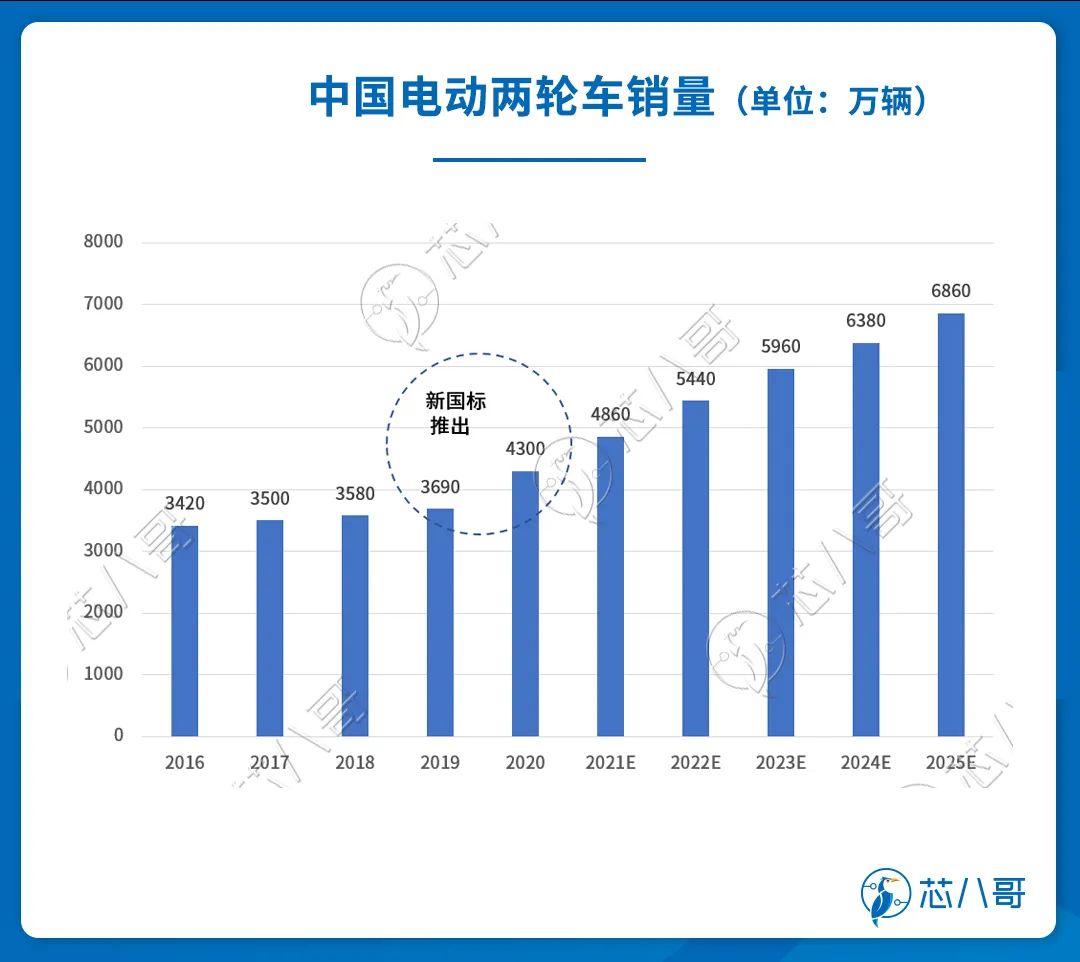

Intelligent electric two-wheeled vehicle: create a new era of intelligence

Driven by the emission reduction policy and the progress of motor and battery technology, the sales of electric two-wheeled vehicles have increased rapidly in the past five years. After the arrival of the era of new energy vehicles, numerous enterprises have entered the market across industries. Some have chosen to manufacture their own cars, and some have become part of the supply chain. Great changes have also taken place in the whole industry. For example, lead-acid batteries have been almost completely eliminated, and lithium batteries have become the mainstream, accounting for about 30% of the cost. Therefore, under this trend, two-wheel electric vehicles still have great development space, which is also the reason for Huawei‘s entry into the smart electric vehicles.

Recently, Tailing joined Huawei in the two-wheel electric vehicle industry in China. Tailing has always ranked the top three in the two-wheel electric vehicle industry. It is estimated that the annual sales will be close to 10 million in 2022. Now we have reached a cooperation with Huawei, which is likely to achieve an annual sales volume of more than 10 million in 2023. With the support of Huawei and Hongmeng, the fame and brand value of Tailing will be higher. The Tailing electric car has realized functions such as mobile phone app control and detection. The support that Huawei can provide for it should mainly come from HarmonyOS. For example, it can be controlled through the wallet app, NFC and other functions of Huawei‘s mobile phone, and connected with Huawei‘s computers, tablets and other devices.

After cooperation with Huawei, perhaps Tailing will consider adding a larger screen and on-board Hongmeng system to the electric car, and adding some navigation and entertainment functions. In addition, the existing two-wheel electric vehicles basically do not have radar, camera and other hardware, let alone a tachograph. Huawei may be able to simplify the Hongmeng intelligent cockpit and transplant it to the two-wheel electric vehicle to add more relevant functions. The addition of these software and hardware functions will greatly improve the smart electric vehicle. More importantly, with Huawei‘s participation, the whole industry will be subversive.

Among the leading brands such as Yadi, Emma, Tailing, Xinri, Lvyuan and Xiaoniu, Emma has the most obvious advantages over its competitor Yadi. According to statistics, in 2021, the total market share of Yadi and Emma electric two-wheeled vehicles accounted for 44.7%, while the market share of Tailing ranked third was 13.1%. According to the data of China Bicycle Association, the sales volume of two-wheel electric vehicles in China will be about 53 million in 2022, and it is expected that the sales volume will be about 60 million in the next three years. With the increasing number of cars, it is likely that more urban residents will give up driving cars and drive electric vehicles with low traffic jam probability. In fact, Tmall and Huawei have seen huge business opportunities among them and have joined hands to quickly occupy a larger market.

Data source: sorted out by China Commercial Industry Research Institute and Core Starling

People‘s yearning for a better life is endless. Looking forward to the future, with the joint efforts of domestic and foreign demand and capital, driven by the trend of smart home, automobile, new energy and the universe, more and more promising consumer electronics products will appear in the new consumer electronics market in the future.

|

Disclaimer: This article is transferred from other platforms and does not represent the views and positions of this site. If there is any infringement or objection, please contact us to delete it. thank you! |