Gartner: semiconductor forecast in 2013, excess inventory or new normal

Time:2023-03-13

Views:1135

Source: Core List

Recently, Gartner Japan, a subsidiary of Gartner Japan, held a press conference. Mr. Masatsune Yamaji, senior director and analyst of the company, analyzed the semiconductor market at the conference. Although the overall growth slowed in 2022, it exceeded $600 billion for the first time. With regard to the outlook for 2023, he said that the consumption sector is expected to decline, but there is still room for growth in the automotive sector. For the problem of excess inventory, he believed that this might be the "appropriate level of the new normal".

It will exceed US $600 billion for the first time in 2022

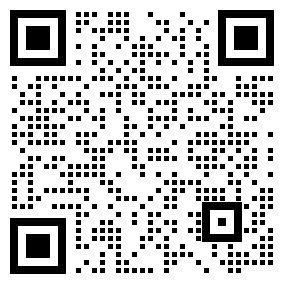

According to Gartner, the semiconductor market will reach a peak of about $400 billion by 2020, and grow rapidly and exceed $500 billion by 2021. In 2022, despite a year-on-year increase of 1.1%, it broke through the $600 billion mark for the first time.

From the perspective of terminal market, while the automotive, wired network, consumer and industrial sectors are growing, major markets such as PC, server and smart phone are greatly affected by the downturn, the wireless sector is down 3.8%, and the storage sector is also affected by SSD price reduction, down 4.3%.

Mr. Yamaji explained that "whether DRAM or NAND flash memory, the application fields using large amount of memory have declined. But the automotive and industrial fields with low demand for memory capacity have seen considerable growth. The automotive, cable network and industrial fields have shown strong growth in the double-digit percentage range."

Semiconductor market in 2022 (by terminal market)

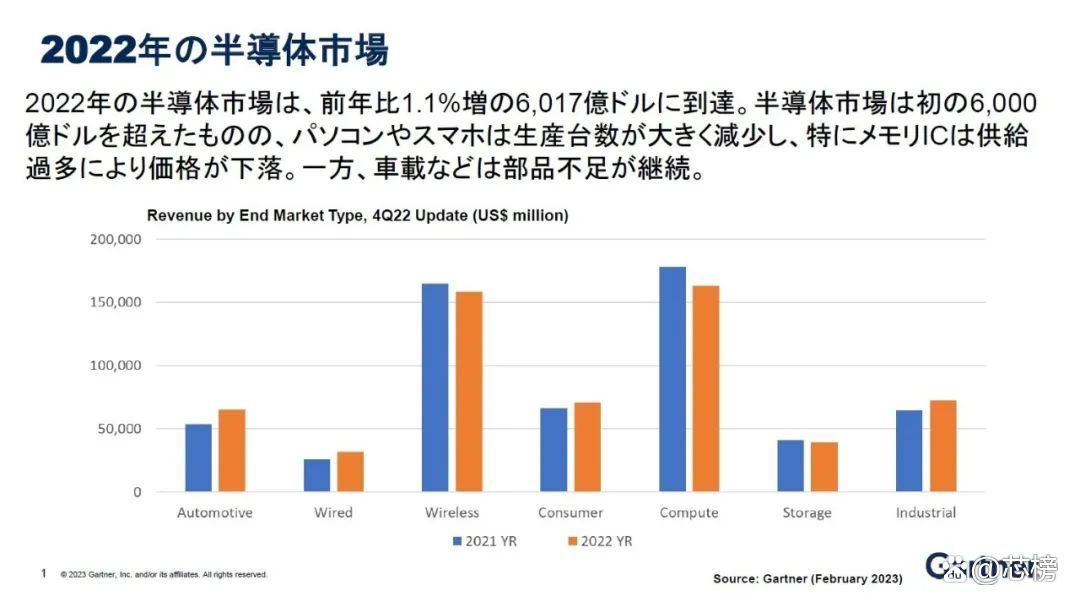

The sales of manufacturers in the consumer market also declined significantly. According to the ranking of semiconductor sales of various manufacturers in 2022, Samsung Electronics ranked first fell 10.4% year on year, while Intel ranked second declined 19.5% year on year due to the downturn in the consumer market.

Under the overall difficult situation of the smartphone market, Qualcomm increased its orders with high-end products, up 28.3% year on year. Broadcom also achieved a year-on-year growth of 26.7% due to its active investment in communication infrastructure against the background of the popularity of online conference and streaming media services.

AMD‘s games also performed strongly, with the acquisition of Xilinx contributing 42.9% year-on-year growth.

Top 10 semiconductor sales by supplier in 2022

Double-digit growth of auto sales in 2023

This time, the company also predicted that the size of the semiconductor market would shrink by 6.5% to US $562.7 billion in 2023 compared with the previous year, and shrink again to US $500 billion.

From the perspective of the terminal market forecast, the wireless, computer and consumer sectors centered on smart phones are expected to decline year-on-year. Mr. Yamaji said, "We expect that memory sales will decline by nearly 20% in 2023, which will have a great impact on memory usage. The wired network and industrial machinery sectors are expected to remain basically flat."

On the other hand, the auto sector is expected to maintain growth, with a year-on-year growth of 12.6%. This is because the supply of semiconductors is in short supply, and the auto manufacturers and Tier 1 manufacturers have placed more than one year‘s advance orders to the semiconductor manufacturers under the condition of being unable to cancel, and it is expected that the sales will even rise,

However, Mr. Yamaji said, "I do not expect that these backlog orders will continue to accumulate in 2023. Because various markets will start to stop or reduce orders in order to make adjustments throughout 2023. At present, even Tier 1 manufacturers have a large amount of inventory, and there will be a corresponding amount of order backlog throughout 2023." In this case, the semiconductor market is expected to be active as a whole in 2024, but the automotive sector is expected to have market adjustments.

Excess inventory is also an appropriate level of the "new normal"

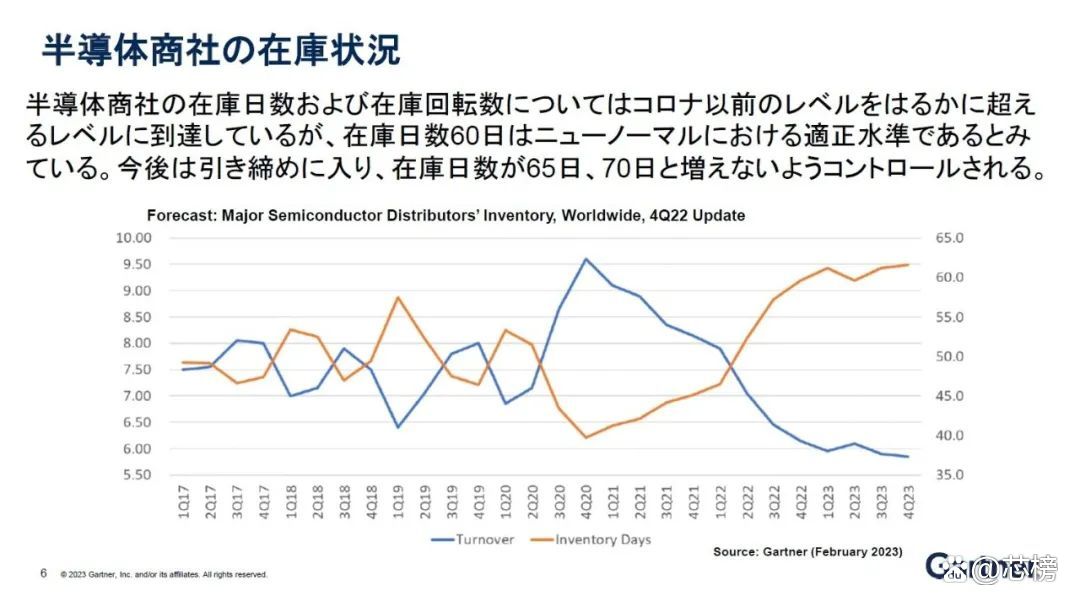

As for the inventory of semiconductor trading companies, before the epidemic, the number of days of inventory was about 50 days, and the inventory turnover rate was about 7.5, with repeated small increases and decreases. However, in the fourth quarter of 2020, the shortage of semiconductors became more serious. The number of inventory days was about 40 days, and the inventory turnover rate reached 9.5. However, it is said that although the demand for semiconductors is insufficient, the inventory continues to increase slightly, and from the beginning of 2022, the inventory will rise sharply. At present, the inventory days are about 60 days, and the inventory turnover rate is 6. "It has reached the level of excess inventory in the past."

Changes in inventory status of semiconductor trading companies

However, Mr. Yamaji explained that the current level was considered to be the appropriate level under the new normal. As a background, he said: "Globally, companies that used to purchase directly from semiconductor manufacturers are now increasingly purchasing through trading companies. As for small electronic equipment manufacturers, more and more activities use trading companies and let them hold inventory."

|

Disclaimer: This article is transferred from other platforms and does not represent the views and positions of this site. If there is any infringement or objection, please contact us to delete it. thank you! |