Shipped over 100 million units, this type of domestically produced MCU can be replaced with ST by pin to pin replacement

Time:2023-12-09

Views:503

As one of the control cores of electronic products, MCU (Microcontroller, commonly known as Microcontroller) plays an indispensable role in the development of intelligence in modern society.

Fearless of industry adjustments, achieving counter trend growth in multiple segmented markets

In terms of market size, according to IC Insights, the global MCU market size was approximately 19.6 billion US dollars in 2021, and it is expected to maintain a compound growth rate of 6.7% over the next five years. By 2026, the market size will reach 27.2 billion US dollars.

Although the market space is vast, due to the low entry threshold, the entire industry is currently filled with a large number of MCU manufacturers. It is actually very difficult to grow and strengthen in the extremely fierce industry competition. After years of development and integration through mergers and acquisitions, according to YOLE‘s data, Infineon, Renesas, and NXP are currently tied in the top three with 18% of the market share in the MCU market. Although the top five manufacturers do not have a single dominant company, their combined proportion accounts for 81.5% of the overall MCU market share.

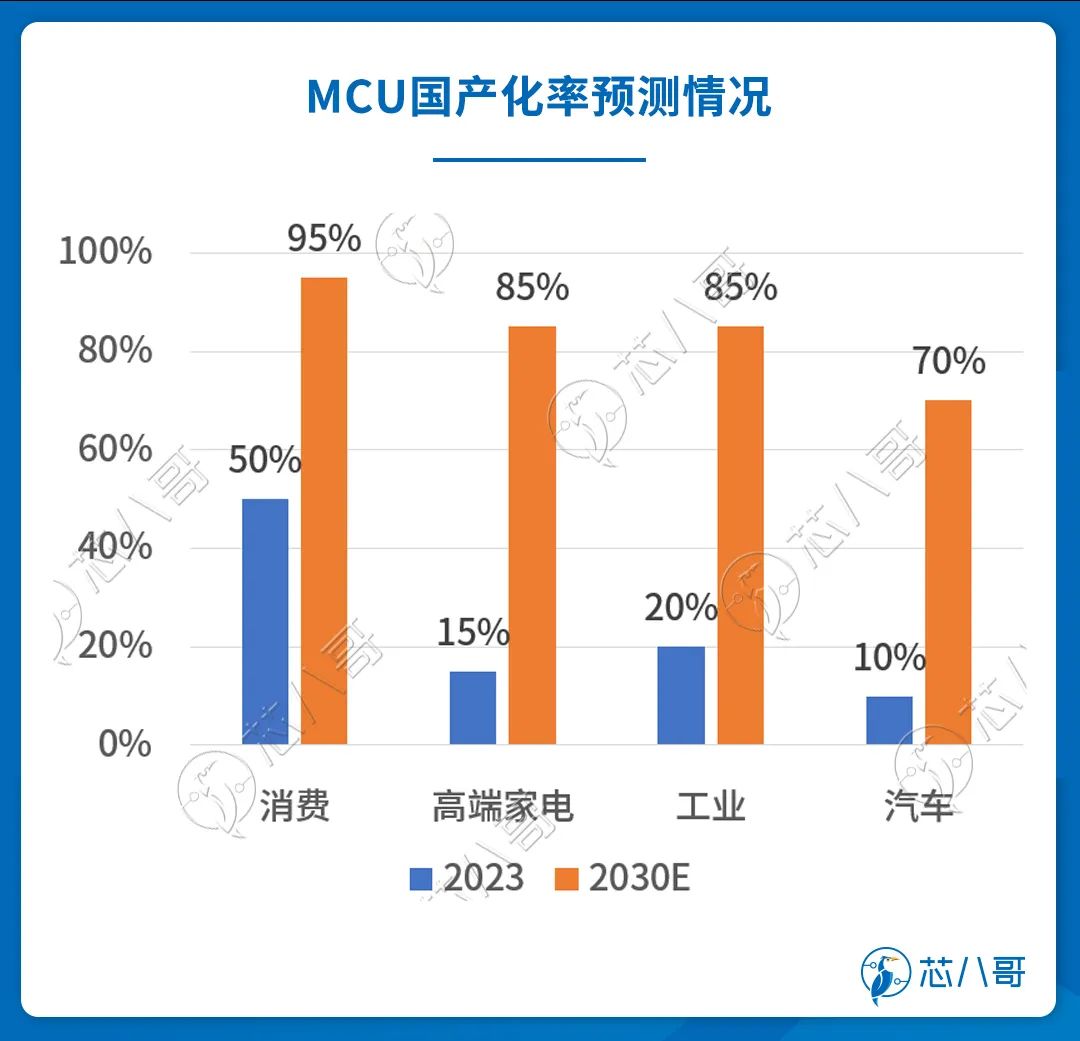

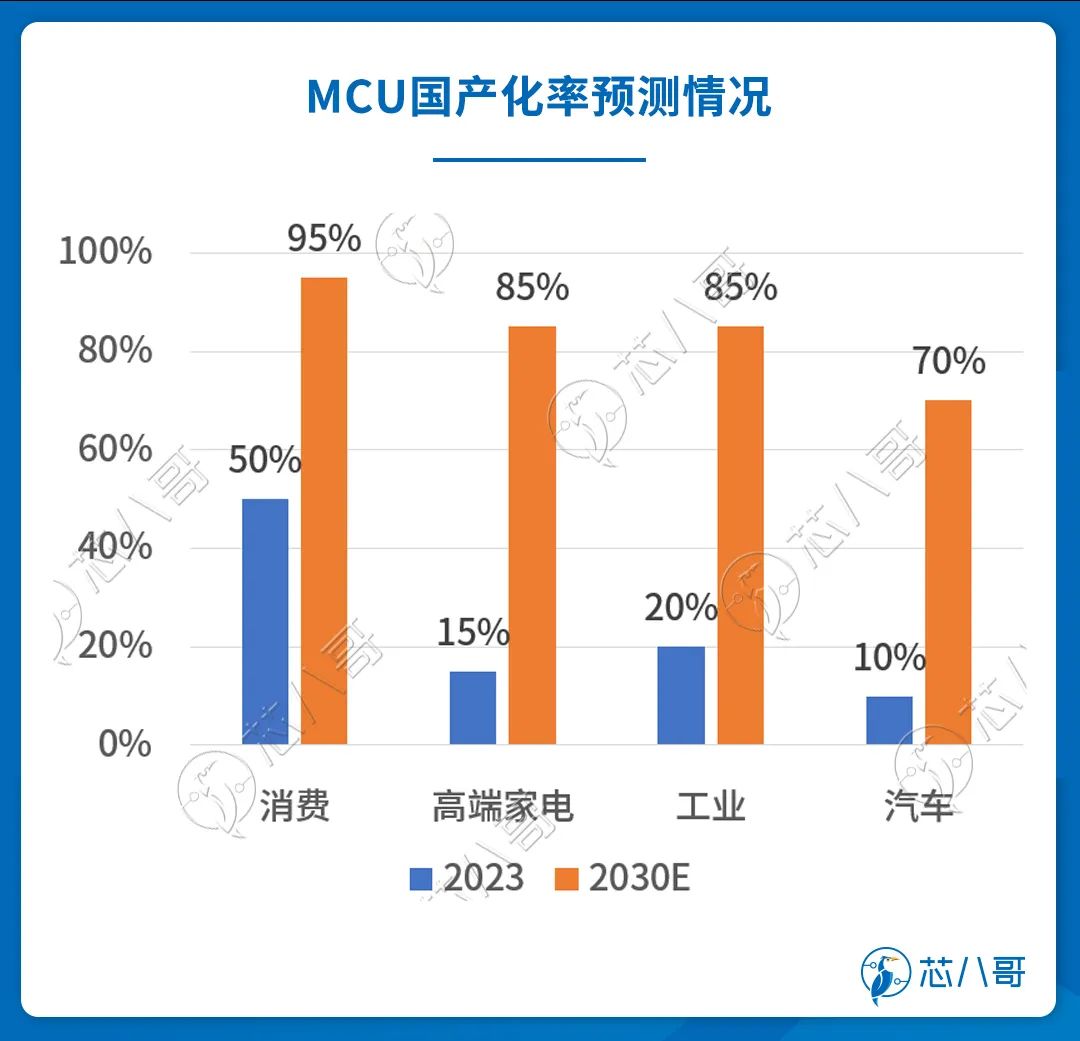

When talking about the current competitive landscape in the industry, Zeng Guangming, Deputy General Manager of Xiaohua Semiconductor, pointed out that currently, international brands such as Infineon, NXP, and Renesas still have a larger market share in the MCU market. However, with the continuous growth of domestic end customers‘ demand for independent and controllable supply chains, it is expected that the market share of domestic MCU manufacturers will continue to increase in the future. Among them, in the field of consumer MCU, localization has reached around 50% in 2023, and it is expected that this proportion will increase to 95% by 2030; In the field of home appliances, especially high-end home appliances, the proportion of domestically produced MCUs is currently around 15%, and it is expected that this proportion will increase to 85% by 2030; In the field of industrial MCU, the localization rate in 2023 is around 20%, and it is expected to further increase to 85% by 2030; In addition, with the rise of domestic automotive brands, domestic automotive MCUs have experienced rapid development since 2020, accounting for 10% of the total. It is expected that this proportion will further increase to 70% by 2030.

Source: Xiaohua Semiconductor

Since Q2 2022, MCU prices have begun to adjust due to the weakening demand for consumer electronics represented by mobile phones and PCs. Subsequently, the downturn in consumer electronics gradually spread to the Internet of Things and industrial sectors, and the entire industry entered a downward cycle. By Q3 2023, after more than a year of cyclical adjustments, the inventory levels of major manufacturers have significantly decreased compared to peak periods. However, in a situation where demand is not clear, most manufacturers still struggle with Q3 performance.

Internationally, the performance growth rate of the top five MCU manufacturers worldwide has begun to slow down, with Renesas Electronics and NXP Semiconductor experiencing a year-on-year decline in revenue in the first three quarters of 2023; In the domestic market, due to the current dominance of MCU manufacturers such as Zhaoyi Innovation, Zhongying Electronics, Xinhai Technology, Zhongwei Semiconductor, and National Technology in the home appliance, consumer electronics, and Internet of Things markets, they have been greatly affected by the sluggish market this year, with generally poor performance in the first three quarters.

From the comparison of revenue in the first three quarters of this year, Zhaoyi Innovation, Zhongying Electronics, National Technology, Zhongwei Semiconductor, and Xinhai Technology saw revenue declines of 35.08%, 26.55%, 18.66%, 8.72%, and 41.56% respectively. Meanwhile, Xiaohua Semiconductor‘s revenue increased by 8.10% year-on-year in the first three quarters of this year, making it one of the few manufacturers in the MCU industry to achieve counter trend growth during the industry downturn cycle.

Zeng Guangming said that in terms of inventory amount, currently Xiaohua‘s inventory amount is around 250 million, and compared with other competitors, the inventory level is still relatively low. From the perspective of more important inventory turnover indicators, Xiaohua‘s turnover rate is around 1.6 times, which is significantly higher than other manufacturers and is in a very benign operating condition.

Why can Xiaohua Semiconductor achieve counter trend growth during the industry downturn cycle?

According to Zeng Guangming, as a failure chip design company, Xiaohua not only has hardware strength in chip reliability design, testing and development, integration design, network/functional integration, but also has high R&D investment, first-class technical services, and a rich software ecosystem. Through a comprehensive layout of software and hardware, Xiaohua Semiconductor has gradually formed its core competitiveness in the MCU field.

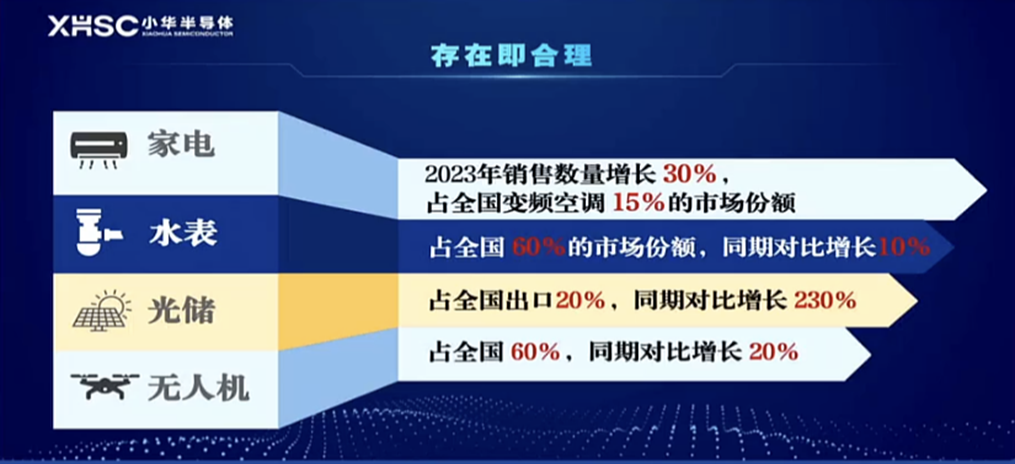

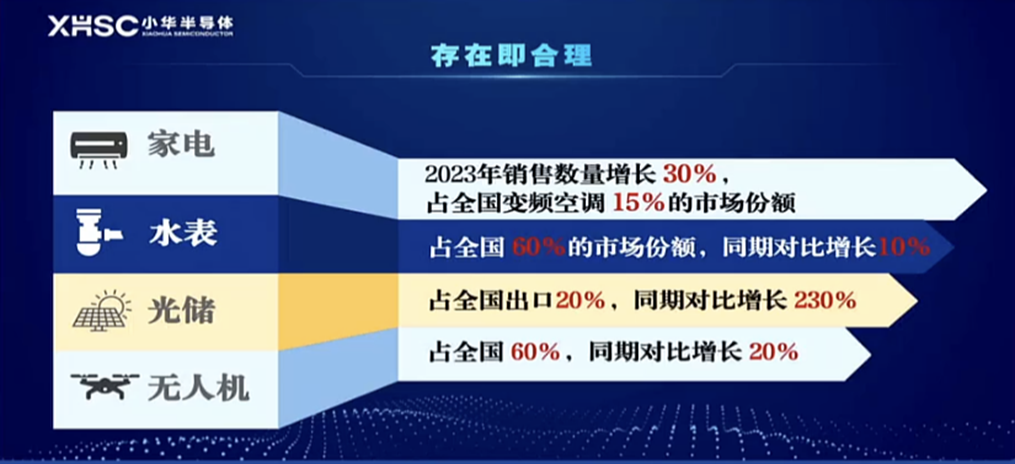

In the first three quarters of this year, Xiaohua‘s main MCU product lines achieved relatively excellent performance compared to the same period last year. Among them, in the field of home appliances, Xiaohua‘s sales volume increased by 30% in 2023, and the cumulative shipment has exceeded 100 million units. Especially in the field of variable frequency air conditioning, Xiaohua has broken the monopoly of imported chips, with a market share of 15%, and is in a leading position among domestic MCU brands; In the water and gas meter industry, Xiaohua‘s MCU has accounted for about 60% of the national market share in the water meter field, an increase of 10% compared to the same period last year; In the field of optical storage, Xiaohua accounts for 20% of the national export market share, and shipped over 10 million units in the first three quarters of this year, a year-on-year increase of 230%; In addition, in the drone market, the company currently has a market share of about 60% nationwide, an increase of 20% compared to the same period last year.

The main MCU product lines have achieved excellent performance compared to the same period last year

Source: Xiaohua Semiconductor

Can replace similar ST products with Pin to Pin, and the shipment volume of star products has exceeded 100 million

With the wave of industrial automation brought about by the development of the global digital economy, the application of MCU in the industrial market has become increasingly widespread. In addition to common scenarios such as traditional industrial automation, motors, frequency converters, instruments and meters, the current development of markets such as wind power generation, photovoltaic energy storage, robots, communication, and data centers has also opened up new space for the development of the industrial market.

Source: Xiaohua Semiconductor

Unlike the general MCU market, Microelectronics, Texas Instruments, and STMicroelectronics have advantages in the industrial sector. Among them, Microchip formed a comprehensive coverage product line in the industrial control field by acquiring Atmel in 2016; Texas Instruments relies on the full signal chain design capability of analog chips to fully leverage the industrial market that requires dynamic monitoring of production signals and timely adjustments, and has absolute technological advantages in low-power products; The main application area of STMicroelectronics 32-bit general-purpose MCU is in industrial scenarios (B2B industry, consumer industry, professional industry, etc.), and it is planned to further increase the proportion of industrial MCU from 52% in 2021 to 65% in 2026 in the future.

As one of the manufacturers with a relatively complete product line in the domestic industrial MCU field, Xiaohua Semiconductor has formed a rich series of products around the M4 and M7 cores. Among them, the company‘s M4 core mainly includes multiple series of products such as HC32F420, HC32F334, HC32F448, HC32F4460, HC32F48x, and HC32F4A0, while the M7 core currently has different series of high-end products such as HC32H72x, HC32H7A7, and HC32H76x.

Zhang Jianwen, Product Director of Xiaohua Semiconductor, pointed out that HC32F460 is a product launched by Xiaohua Semiconductor in early 2019, which can be used as a substitute for ST products of the same model. After its launch, it received enthusiastic feedback from the market, and as of now, the shipment volume has exceeded 100 million units; HC32F4A0 is a flagship version of the M4 product launched by the company in early 2020, with sales exceeding 30 million units so far; In the first half of 2023, we launched two industrial products, one of which is the entry-level HC32F420 product, which can be replaced with similar products from ST as Pin to Pin. Another product is HC32F448, with a main frequency of up to 200MHz and a Flash of 256KB; In addition, HC32F472 is another popular product that we are currently focusing on recommending in the market. This product has rich peripheral simulations and can be applied to multiple markets for optical modules.

Specifically, HC32F472 adopts an M4 core with a main frequency of up to 120MHz and memory of 68KB SRAM and 512KB Flash, respectively. In addition, the product also comes with an 8-channel 12-bit DAC, which can drive up to 10mA per channel. Built in 2.5V high-precision VREF, with a maximum communication rate of 1Mbps for I2C, using BGA64 (4 * 4) small package, it has the characteristics of high performance, high integration, high security, and multiple packages.

Zhang Jianwen stated that compared to its competitors, HC32F472 supports hardware acceleration units such as DCU/MAU/FMAC on the kernel; In terms of memory, the SRAM of this product is 68KB, far higher than the 64KB and 32KB of its competitors; On analog peripherals, the ADC of this product supports 3 units; Finally, in terms of security, the product supports data encryption protection such as TRNG, AES-256, SHA-256, etc., to imitate untrusted data and endanger product security. Although this product is mainly aimed at the transmission network and data center of optical modules, due to its powerful simulation function, it is also suitable for other market applications that require strong simulation performance.

In addition, the HC32F448 series is a product launched by Xiaohua for entry-level industrial control applications. This product adopts ARM Cortex-M4 core, with a main frequency of 200MHz, built-in 256KB Flash and 68KB SRAM, with a Vcc of 1.8-3.6V. It integrates three 12-bit 2.5MSPS SAR ADCs, two 12-bit DACs, two I2C, two CAN and other peripherals, and comes in five packaging options: QFN32/QFN48/LQFP48/LQFP64/LQFP80.

The HC32F448 series product is a MCU with high computing power, rich simulation characteristics, and integrated motor exclusive Timer. It was mass-produced around June this year. According to different technical parameters, it can be divided into 10 different models of products. In addition to continuing some applications of HC32F460 air conditioning dual motor control, this series of products can also be widely used in industrial control vertical subdivision scenarios with high reliability requirements, such as stepper motors, low-voltage frequency converter main control, and servo industrial encoders.

Zhang Jianwen said.

Source: Xiaohua Semiconductor

The automobile MCU has achieved batch shipment, and the synergy of software and hardware is driving the development of the automobile industry forward

In addition to the industrial market, with the development of automotive electrification, intelligence, and networking, automotive electronics has accounted for 35% of the major MCU application markets in 2022, becoming the largest MCU application market currently.

In terms of market size, according to IC Insights, the market size of automotive MCU reached 7.6 billion US dollars in 2021. Driven by the accelerated transformation of the automotive electronic and electrical (E/E) architecture, the number and value of MCU bicycles will continue to increase in the future, and the market size is expected to reach 11.6 billion US dollars by 2025.

It is worth noting that due to the high barriers and gross profit characteristics of the automotive MCU market, it has always been a coveted market for many MCU manufacturers. However, it is precisely due to its high technology and high entry barriers that the market has long been highly monopolized by American, Japanese, and European companies such as Renesas Electronics, NXP, and Infineon. More than half of Infineon‘s 32 billion euro order backlog in Q2 this year was for automotive orders. The company believes that the automotive MCU tension will continue throughout 2023.

In the domestic market, MCU manufacturers mainly focused on consumer electronics, the Internet of Things, and home appliances have also begun to actively expand into the automotive MCU market in the face of fierce competition. However, currently, most domestic manufacturers are still in the initial stage of their automotive MCU business, with overall shipments being small, with only a few companies shipping over ten million units.

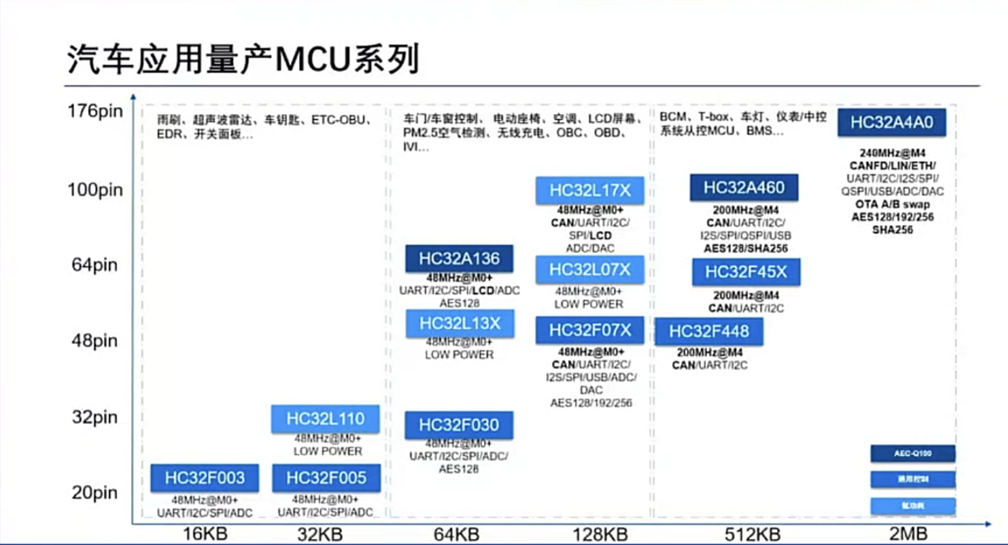

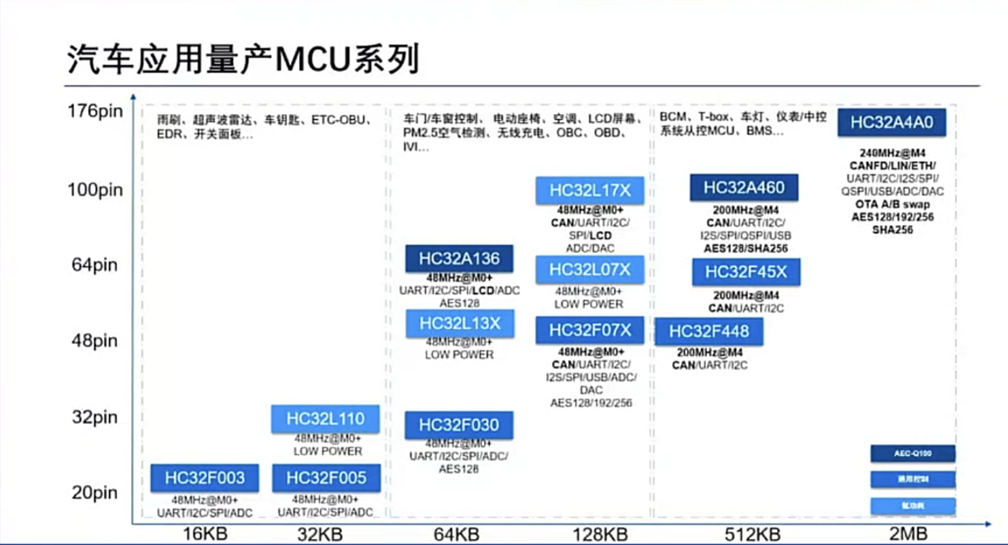

As one of the earliest companies in China to conduct in-depth layout in the field of automotive MCU, Xiaohua obtained AEC-Q100 certification for its first automotive MCU as early as 2019. Since then, the company has obtained ISO 26262 automotive functional safety ASIL-D level R&D process certification. As of now, the company has a complete development process and quality control system for automotive grade MCU chips, and has formed three major MCU sub product lines: universal body, functional area control, and power safety, covering four specific applications: body, cabin, chassis, and new energy.

Source: Xiaohua Semiconductor

Xu Kaixiao, Deputy General Manager of Xiaohua Semiconductor Automotive Business Unit, stated that in the field of automotive MCU, the company has formed three major series of products: HC32A/XC1 series, XC2 series, and XC314 series. Among them, the HC32A/XC1 series supports Arm Cortex MO+or M4, with a maximum frequency support of 240MHz, Flash support of 64KB-2MB, and support for multiple vehicle communication interfaces such as CANFD and LIN. It is mainly used in the field of distributed small nodes in the vehicle body; The XC2 series supports single core and multi-core Arm Cortex-M7, Flash supports 1MB-8MB, and rich ETH/CANFD communication interfaces, which can be applied in scenarios such as distributed main node control of vehicle bodies, gateway vehicle domains, and regional control; The XC314 series adopts multi-core locking step ArmCortex-M7, R52+, higher main frequency and large capacity memory, rich simulation performance, and can be widely used in power, chassis domain control, new energy three electric systems, wire controlled chassis, braking, EPB, EPS and other fields.

Source: Xiaohua Semiconductor

Specifically, HC32A136 adopts a Cortex MO+core with a main frequency of 48MHz, and has a 64KB Flash memory and 8KB RAM memory. It is equipped with a 12 bit 1Msps SAR ADC, a 6-bit DAC, and a 2-channel VC programmable reference input. It can be applied to low-power small node control such as ETC and PM2.5 sensors; The HC32A460 product adopts Cortex-M4 core, with a main frequency of 200MHz and 512KB Flash memory/192KB RAM memory, which can be applied in scenarios such as vehicle node control and small motor control; HC32A4A0 is the company‘s star product, with a maximum frequency of 240MHz and a Cortex-M4 core. It is equipped with a wide range of high-performance simulation and communication interface peripherals, and can be applied to control master nodes such as BCM, T-box, car lights, central control, and BMS; The XC27 products of the XC2 series can be widely used for controlling a series of scenarios such as car doors, sunroofs, headlights, and windshield wipers, and are expected to be launched in the market soon.

In recent years, with the increasing trend of "software defined cars", vehicle grade MCUs that support the AUTOSAR standard have become a development trend in the industry.

Xiaohua Semiconductor actively grasps the downstream market direction and has been laying out in the AUTOSAR field for many years. Currently, it has developed MCU underlying driver software MCAL technology that meets AUTOSAR standards. In the future, vehicle grade MCUs that support AUTOSAR standards will further enhance the company‘s market competitiveness.

Source: Xiaohua Semiconductor

Xu Kaixiao pointed out that Xiaohua‘s AutoSAR has now been upgraded to version 4.4.0, and MCAL also supports a series of drivers such as communication interfaces and IO interfaces, as well as a series of compilers, configuration and code production tools, and optional debuggers. At present, the entire software and hardware development process of Xiaohua has been carried out in accordance with strict standards such as IS026262 ASIL D and ASPICE L2, and the supported chips include XC2XX, HC32A4A0 and other series. In addition, according to the different needs of customers, the company has developed multiple sets of software, among which the standard software is free for customers to use (included in MCU prices). Of course, the company also provides more advanced software, and customers with needs can come to customize it with us.

Based on the company‘s long-term deep cultivation in the automotive field, Xiaohua has formed deep cooperation with manufacturers such as SAIC, Geely, Hongqi, Great Wall, BYD, and Xiaopeng. In the future, Xiaohua Semiconductor will continue to focus on the core applications of automotive electronics on the basis of its existing product line, develop high-end multi-core automotive MCU, continuously expand the variety of product lines, provide OEM and TIER 1 with more choices, and further promote the development of the intelligent automotive industry.

MCU belongs to the industry with low entry barriers but high development barriers. In recent years, domestic manufacturers have gradually crossed the boundary between high and low end markets, expanding into high barrier, high gross profit industrial control, automotive and other mid to high end markets, in order to achieve stable profitability and significant development.

As the top tier manufacturer in the domestic MCU industry, Xiaohua Semiconductor has always been driven by technological innovation, focusing on solving the core needs of high-end industrial and automotive electronics industries, and striving to build itself into a technology hub for domestic high computing power, high-precision industrial control MCUs and high-end automotive electronics MCUs. I believe that with the continuous enhancement of comprehensive competitive strength, Xiaohua Semiconductor will become a MCU manufacturer with both strategic support and global competitiveness.

|

Disclaimer: This article is transferred from other platforms and does not represent the views and positions of this site. If there is any infringement or objection, please contact us to delete it. thank you! |