With an annual production capacity of 240000 pieces, this silicon carbide IDM manufacturer has achieved bulk shipments

Time:2024-02-19

Views:393

Source: Octopus Core Author: Joey

SiC has excellent characteristics such as large bandgap width, high breakdown electric field strength, and high saturation drift velocity, and has become one of the hottest and most promising materials in the semiconductor field.

Recently, a reporter from the "Entering the Industry Chain" column of Xin Ba Ge interviewed Huang Hongliu, Deputy General Manager of Jiefang Semiconductor, a new domestic silicon carbide IDM enterprise, to explore the breakthrough path for Jiefang Semiconductor to achieve rapid growth in the context of the explosive development of silicon carbide.

Focusing on high barrier markets, our products have been shipped in bulk in fields such as automobiles and photovoltaics

It is understood that Jiefang Semiconductor was founded in 2021 and is an IDM manufacturer focusing on automotive chips and third-generation semiconductors. Based on the core team‘s over thirty years of rich industry experience, Jiefang has launched multiple series of cutting-edge products such as high-performance silicon carbide (SiC) and analog signal chains to the market, which can be widely used in fields such as photovoltaics, energy storage, and new energy vehicles.

In the field of new energy vehicles, silicon carbide is mainly used in areas such as main drive inverters, on-board charging systems (OBC), power conversion systems (on-board DC/DC), and off board charging stations. According to Wolfspeed‘s prediction, by 2026, the silicon carbide value of inverters in cars will be approximately 83%, making it the most valuable part of electric vehicles. Next is OBC, with a value accounting for approximately 15%; The value of SiC in DC-DC converters accounts for about 2%. In addition, electric vehicle charging stations are also a major application area for SiC devices.

From the perspective of vehicle installation, with the acceleration of the 800V high-voltage platform layout in recent years, in addition to the Tesla Model Y/Model 3, models in the industry including BYD Han EV/Tang EV, NIO ES7/ET7/ET5, Xiaopeng G9, Ideal L9, Xiaomi SU7, Porsche Tayan, etc. have also adopted silicon carbide devices in electric drive. With the trend of domestic and foreign car companies laying out 800V high-voltage platforms, silicon carbide is expected to achieve larger scale growth in the automotive industry in the future.

Source: Jiefang Semiconductor

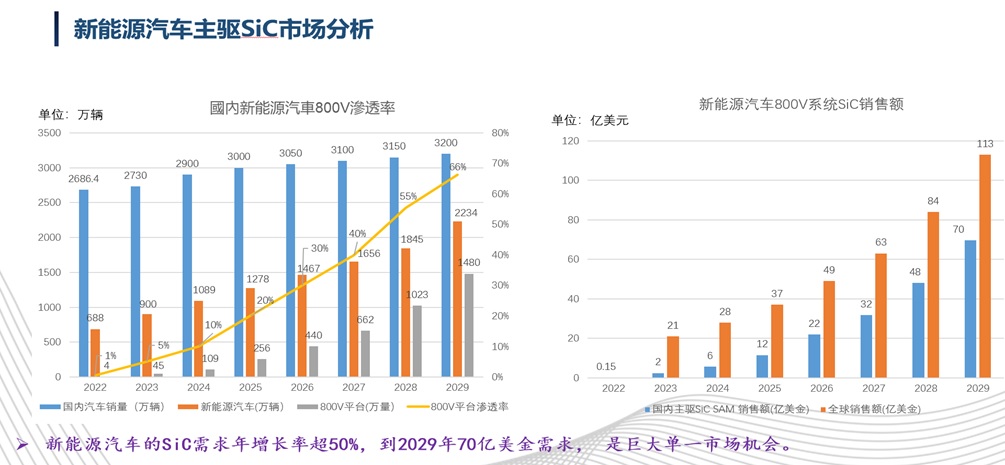

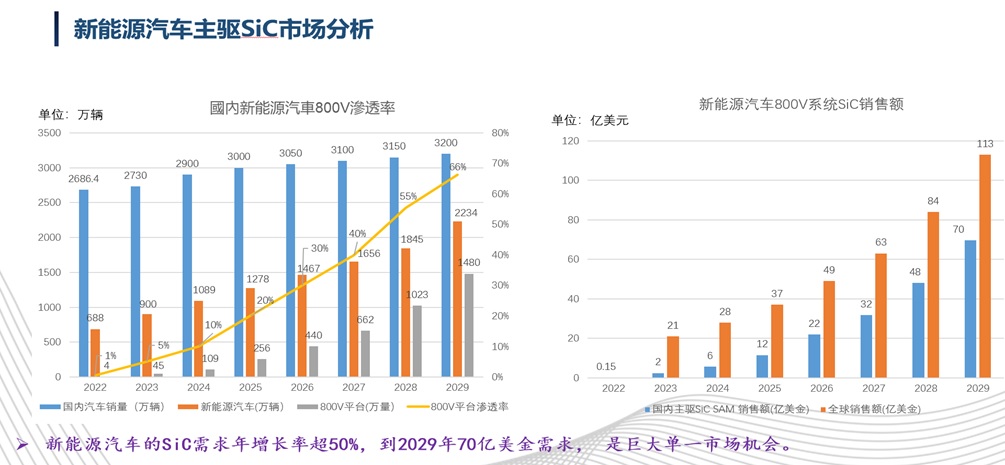

Huang Hongliu, Deputy General Manager of Jiefang, stated that with the acceleration of the transformation of the new energy vehicle industry, global new energy vehicles have experienced rapid development, especially in the domestic market. Currently, manufacturers such as BYD have become leaders in the global new energy vehicle industry. Driven by the continuous shipment of silicon carbide related models from the host factory, the penetration rate of 800V silicon carbide in the main drive is also constantly increasing. According to our prediction, the penetration rate of 800V new energy vehicles in China can reach 66% by 2029, and the related sales will increase to 7 billion US dollars. The entire market will usher in huge development opportunities.

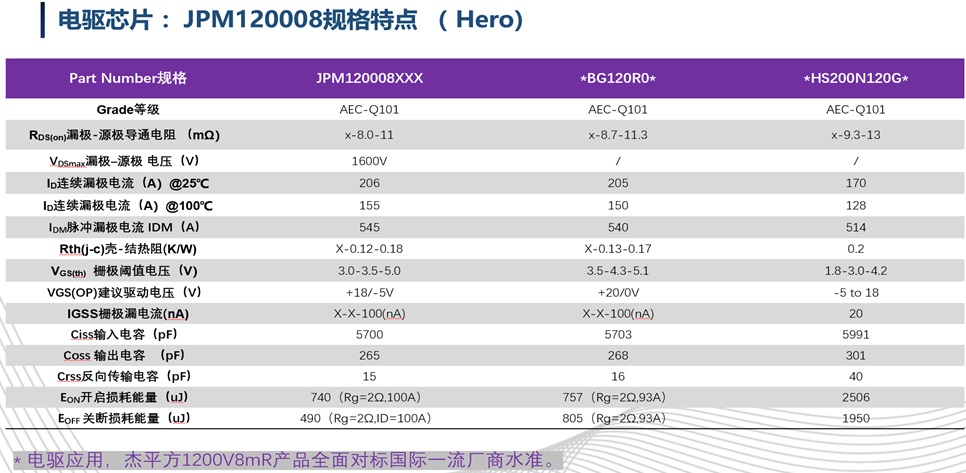

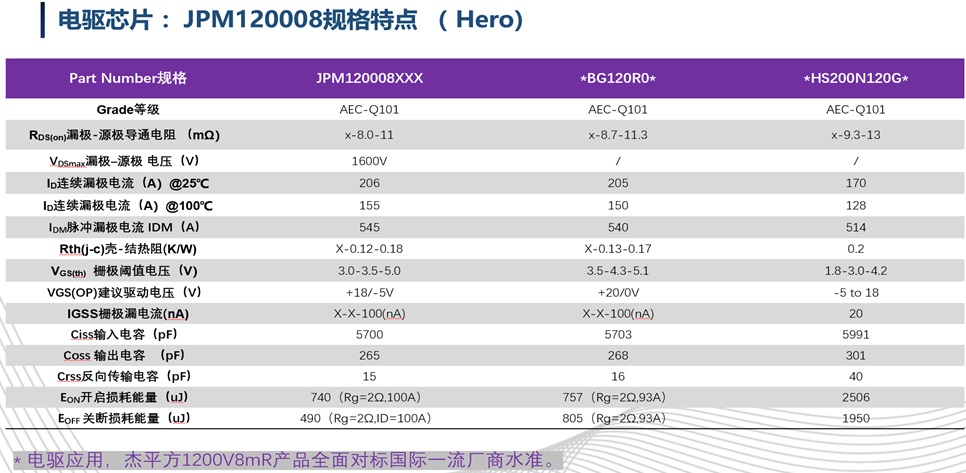

Based on a deep understanding of market demand, Jiefang has currently developed a series of related products for rapidly growing sub markets such as main drive inverters, OBCs, DC/DC, and charging piles. Among them, in the field of main drive inverter, the company has developed series of products such as JPM120008 and JPM120012; In the OBC and DC/DC fields, the company has also launched a series of products such as JPM120020B4, JPM120040B4, JPM120040B4, JPM120080B4, JPM1700650B3, etc; In the field of charging piles, the company‘s JPM120020B4, JPM120040B4, JPM1700650B3 and other series of products can meet the diversified needs of downstream customers.

Source: Jiefang Semiconductor

Specifically, JPM120008 is a main product developed by Jiefang mainly for the electric drive of new energy vehicles, with a voltage of 1200V/8 m Ω. It has a simpler design and comprehensively benchmarks with international first-class manufacturers in terms of technical parameters, which can greatly reduce the cost of the entire system for OEMs; JPM120040 is an N-channel enhanced SiC MOS product launched by Jiefang, with a voltage of 1200V and a conducting resistance of 30m Ω, which is a 30% decrease compared to industry competitors. In addition, this product also features high breakdown voltage, low conduction resistance, high switching speed, easy driving and parallel connection, and high avalanche resistance. It can reduce cooling requirements and system costs for fields such as in vehicle DC/DC converters and in vehicle chargers (OBCs), while improving system efficiency and power density.

Although the company was only established in 21 years, the entire development process has surpassed the vast majority of startups so far. In terms of automobiles, we have already shipped in bulk in the OBC field, with major partners including Changan and FAW Hongqi. Due to the high technical barriers, the entire research and development cycle of automotive main drive products will be relatively long. We have been working on this research and development for almost two years and are currently accelerating its progress. It is expected to be ready around the second quarter of 2024, and will be released around the third quarter. After verification is completed, it will be launched on the vehicle. Of course, in addition to the host manufacturer, we also collaborate with top tier Tier 1 manufacturers such as Junsheng Electronics to explore complementary mechanisms beyond the global supply chain by customizing automotive simulation chips, in order to create new chip alternatives.

Huang Hongliu said.

Source: Jiefang Semiconductor

In the field of optical storage, silicon carbide devices can increase the conversion efficiency of power generation from 96% of silicon-based to over 99% of SiC MOSFETs, reduce energy loss by 50%, and increase equipment cycle life by up to 50 times. This gives optical storage inverters greater power to replace silicon carbide.

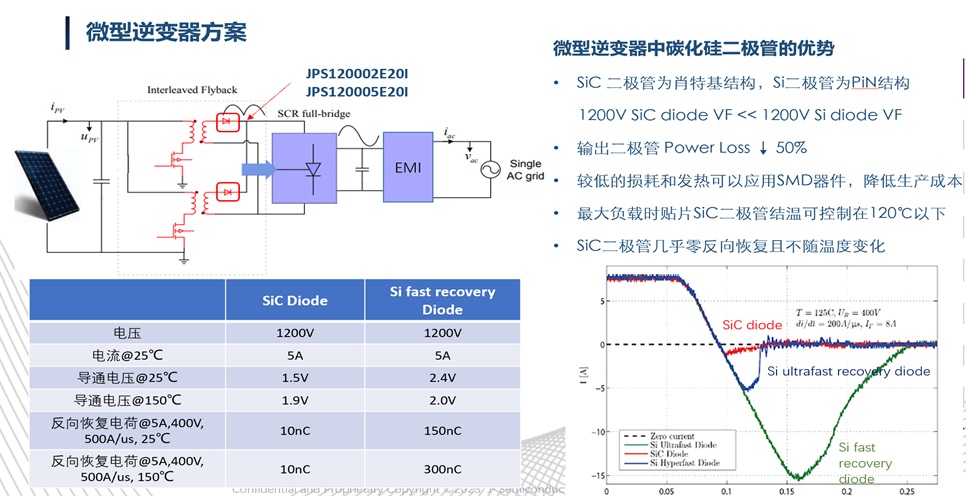

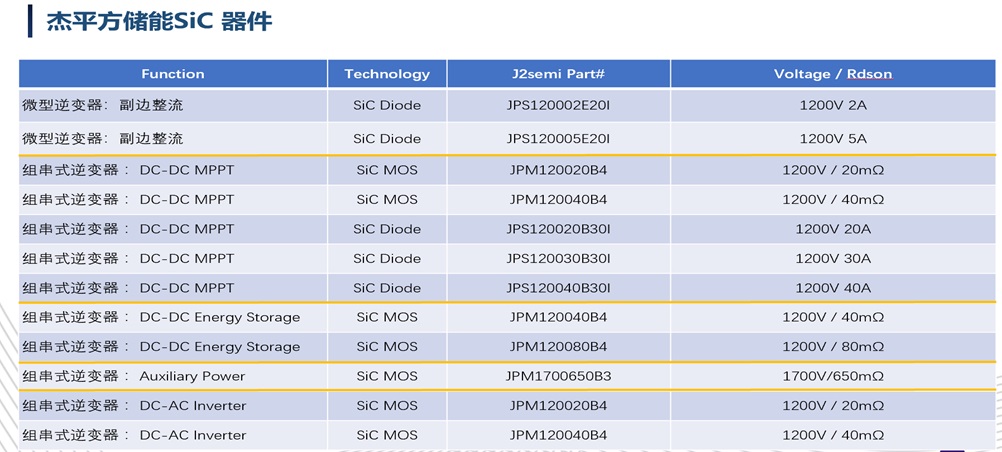

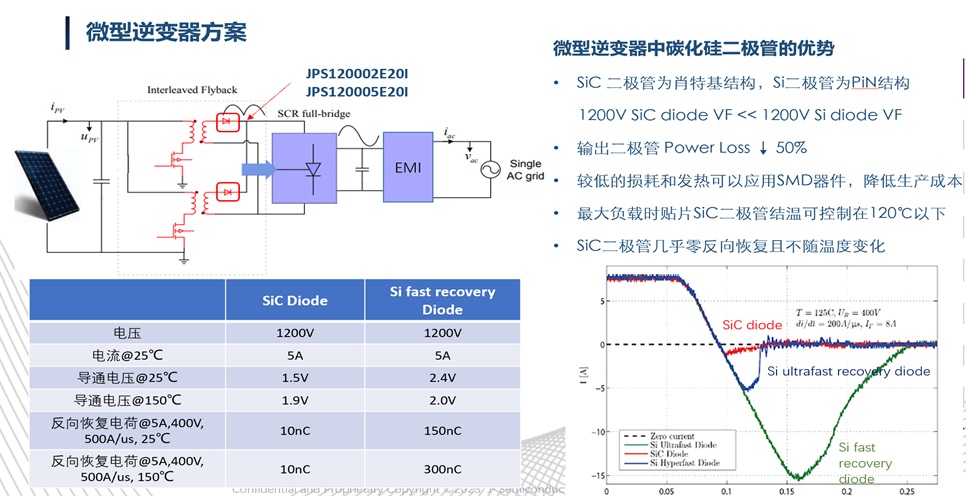

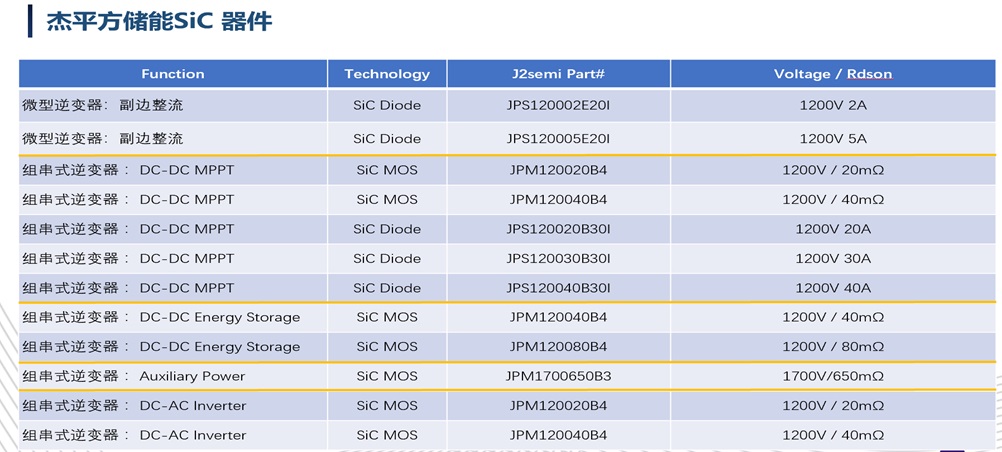

For the vast optical storage new energy market, such as micro inverters and series inverters, Jiefang has also launched multiple series of products, including JPS120002E201, JPS120005E201, JPM120020B4, JPM120040B4, JPS120020B301, JPS120030B30, JPM1700650B3, etc.

Source: Jiefang Semiconductor

Taking JPM120020B as an example, this product is a 1200VSiC MOSFET power device independently developed by Jiefang. It supports a withstand voltage value of 1200V, a conduction impedance of 20m Ω, high temperature resistance characteristics, and a stable operating temperature of up to 175 ℃; In terms of technology, this product adopts advanced thinning technology and has excellent low impedance characteristics, which can reduce the energy loss of the device; In addition, this product also has the characteristics of fast switching speed, low loss, and easy parallel connection, making it very suitable for applications such as photovoltaic inverters with higher conduction current and lower impedance.

Source: Jiefang Semiconductor

Huang Hongliu pointed out that currently, in the field of micro inverters, we mainly focus on silicon carbide diode products. By replacing traditional silicon diode products with silicon carbide diodes, the power loss of output diodes can be reduced by more than 50%, which can help downstream customers minimize production costs to the greatest extent possible; The string inverter mainly adopts a combination scheme of silicon carbide diodes and silicon carbide MOS, which can not only carry higher power but also make the inverter smaller in size. From the perspective of shipment, due to the relatively low technical threshold, silicon carbide diodes have been shipped in bulk to mainstream optical storage customers in Shenzhen and Jiangsu and Zhejiang regions. Meanwhile, we are also rapidly importing string inverter products, which is currently a major shipping direction for the company.

Production capacity reaches 240000 pieces per year! Supported by Xiaomi‘s production and investment, it accelerates its development

In recent years, with the continuous increase in production capacity and yield of silicon carbide devices, their costs have significantly decreased. This not only further accelerates the commercialization process of silicon carbide in various industries, but also brings a sweet spot for the silicon carbide industry to explode.

In terms of market size, according to Yole‘s data, the global silicon carbide power device market size in 2022 was $1.794 billion, and it is expected to maintain a rapid annual compound growth rate of 31% in the next 6 years. By 2028, its market size will reach $8.906 billion.

Source: YOLE

It is worth noting that the current silicon carbide market is still dominated by automotive applications, accounting for 70% of the overall market with a scale of 1.256 billion US dollars in 2022. Driven by the explosive growth of new energy vehicles, the demand for SiC devices in the market is unprecedentedly high, especially as more and more models of main drive inverters use silicon carbide, which will consume most of the global SiC substrate production capacity, and the global substrate production capacity will continue to be scarce.

In this context, the form of long-term orders in the industrial chain is constantly emerging. Downstream host manufacturers can not only lock in production capacity for the next 3-5 years in advance by signing long-term contracts with chip suppliers and Tier1, avoiding chip shortages, but also reduce bulk purchase prices to 2.0-2.5 times that of silicon-based IGBTs, making large-scale production of silicon carbide a reality from theory. It can be seen that international large car companies, including Tesla, Mercedes Benz, BMW, BYD, Stellantis, etc., are currently competing to establish long-term silicon carbide chip supply agreements with chip manufacturers such as Wolfspeed, Infineon, and STMicroelectronics. Various large orders of over $1 billion in the industry are not uncommon.

As is well known in the industry, power SiC IDM remains its mainstream business model, while 6-inch is the mainstream SiC wafer size of leading manufacturers. Under the stimulation of supply and demand, multiple companies in the industry have various capacity expansion plans based on this mature platform. At present, Wolfspeed is the only manufacturer in the world to partially produce on an 8-inch platform. Although multiple manufacturers have announced their intention to follow this strategic decision, there are still many difficulties to overcome from planning to final implementation.

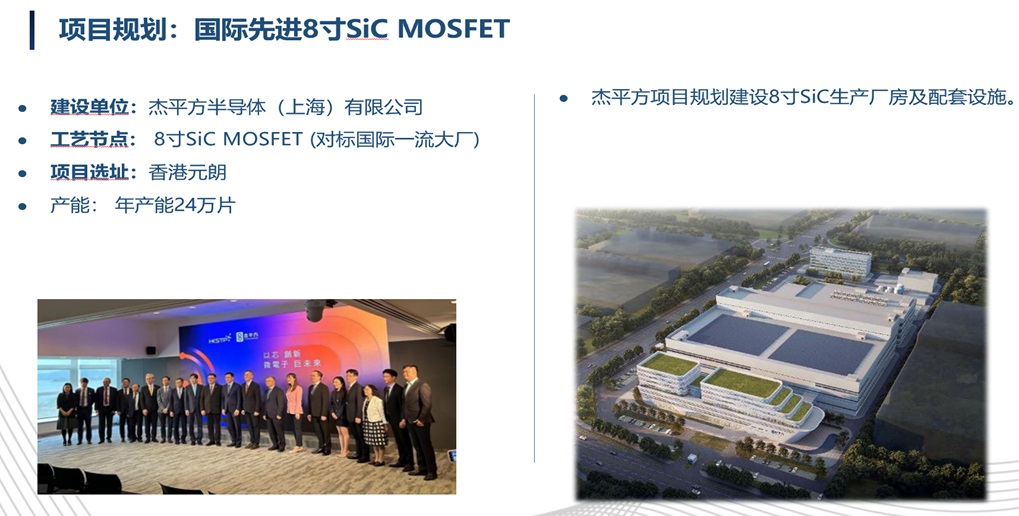

As a cutting-edge enterprise in silicon carbide, Jiefang also uses IDM as its business model and plans to invest a total of approximately HKD 6.9 billion to build an 8-inch silicon carbide wafer factory with an annual production capacity of 240000 wafers in Yuen Long, Hong Kong. It is worth mentioning that this project is the first semiconductor wafer factory in Hong Kong‘s history to have large-scale production capabilities, reflecting the current SAR government‘s emphasis on cutting-edge technology and recognition of the strength of Jiefang Enterprise.

Source: Jiefang Semiconductor

Huang Hongliu stated that Dr. Zu Yongxi, the founder of our company, was one of the first semiconductor core personnel in China to return from the United States, and also one of the co founders of SMIC. He has made tremendous contributions to the development of Chinese semiconductors from scratch. As a veteran with years of experience in wafer manufacturing, he believes that in the silicon carbide industry, one must have their own factory to stand out in the fiercely competitive market. Therefore, based on the founder‘s own resources in the industry, Jiefang is currently actively building its own silicon carbide factory. Our factory is 8-inch, and the equipment requirements and factory automation level are higher than those of 6-inch. The current work of the wafer factory is being carried out according to plan, and it is expected to achieve preliminary mass production by the end of 2025. The production capacity of the first phase is about 240000 pieces per year, which can basically support the demand for 2 million new energy vehicles.

Based on the promising future market development prospects of silicon carbide, in addition to traditional power device giants such as STMicroelectronics, Infineon, and Ansemy making efforts in the field of silicon carbide, there are also numerous startups in various segmented markets within the industry.

When discussing the company‘s competitive advantage, Huang Hongliu pointed out that a core advantage of Jiefang is having its own factory, which means that the company has a strong process capability. We are not a pure design company, we have our own process team, so the company will combine design and process to achieve optimal yield and product performance. If any problems arise during mass production, we can get quick and timely solutions, which is a capability that other companies rarely possess; The second point is that our team is very experienced in building factories. Within our existing team, we have built a total of 13 wafer factories worldwide, which are mainly based on advanced processes. Therefore, we have a deep accumulation in this area and can promote the company‘s various work according to the laws of semiconductor development. Although we will also face various challenges in the process, you have successful experience, Knowing how to avoid and solve various problems that arise in actual operations; In terms of application, we not only have a good understanding of the needs of downstream customers, but also can make forward-looking technological upgrades and innovations to reduce costs and increase efficiency based on the technological evolution of the market, which will accelerate the landing process of our company‘s products in the market.

In order to accelerate the pace of development, Jiefang has also completed multiple rounds of financing, with main investors including Xiaomi Investment, SMIC Juyuan, Linxin Investment, and Qidi Financial Holding. It is worth emphasizing that Xiaomi‘s first new energy vehicle, the SU7, has also adopted an 800V silicon carbide motor solution. As its ecosystem investment company, Jiefang may benefit from the explosion of Xiaomi cars in the future.

Looking ahead to the future, Huang Hongliu stated that Jiefang‘s plan is to become the mainstream manufacturer of global vehicle specification IDMs. To achieve this goal, on the one hand, we will launch a richer product matrix around new energy vehicles. In terms of technological roadmap, in addition to the current flat SiC, we will also actively promote the research and development of groove SiC products to further enhance the overall technological and product competitiveness of the company; On the other hand, in terms of production capacity, we have also planned two wafer factories, and the entire production capacity is in a leading position in the industry. The company has a "Jie square law", which states that for the entire industry, with the continuous evolution of technology and performance improvement, the cost of silicon carbide can be reduced by half every two years. The cost reduction brought about by technological evolution will continue to support the development of the entire new energy industry in the future, focusing on the two core markets of optical storage and new energy vehicles.

|

Disclaimer: This article is transferred from other platforms and does not represent the views and positions of this site. If there is any infringement or objection, please contact us to delete it. thank you! |